Medicare

Coordination of Benefits

Section 111 COB Secure Web Site (COBSW)

User Guide

Version 7.1

Rev. 2013-7/January

COBR-M1-2013-V7.1

Medicare

Coordination of Benefits

Section 111 COB Secure Web Site (COBSW)

User Guide

Version 7.1

Rev. 2013-7/January

COBR-M1-2013-V7.1

Revision History

|

Date |

Version |

Reason

for Change |

|

January 18, 2013 |

7.1 |

Changes listed in Chapter 1. |

|

|

|

|

Confidentiality and Disclosure of Information Section 1106 (a) of the Social Security Act as it applies to the Centers for Medicare & Medicaid Services (CMS) - (42 CFR Chapter IV Part 401 §§ 401.101 to 401.152) prohibits disclosure of any information obtained at any time by officers and employees of Medicare Intermediaries, Carriers, or contractors in the course of carrying out agreements under Sections 1816 and 1842 of the Social Security Act, and any other information subject to Section 1106 (a) of the Social Security Act. Section 1106 (a) of the Act provides in pertinent part that “Any person who shall violate any provision of this section shall be deemed guilty of a felony and, upon conviction thereof, shall be punished by a fine not exceeding $10,000, or by imprisonment not exceeding five year, or both.” Additional and more severe penalties are provided under Title XVIII (Medicare) USC Section 285 (unauthorized taking or using of papers relating to claims) and under Section 1877 of Title XVIII of the Act (relating to fraud, kickbacks, bribes, etc., under Medicare).

These provisions refer to any information obtained by an employee in the course of their performance of duties and/or investigations (for example, beneficiary identification number, beneficiary diagnosis, social security number, pattern of practice of physicians, etc.). Any unauthorized inspection or disclosure of IRS return information in violation of any provision of Section 6103 may bring damages as described in IRC Sections 7431 and 7213, which include, but are not limited to, a fine of any amount not exceeding $5,000 or imprisonment.

Chapter 1: Summary of Version 7.1 Updates

Authorized

Representative (AR) Role

Chapter 3: Section 111 COBSW Login Page

Chapter 5: RRE ID Account Setup & Account Manager Registration

Account

Manager Self-Registration

Log

In to the Section 111 Web Site

Chapter 7: The RRE Listing Page

Chapter 8: Update Personal Information

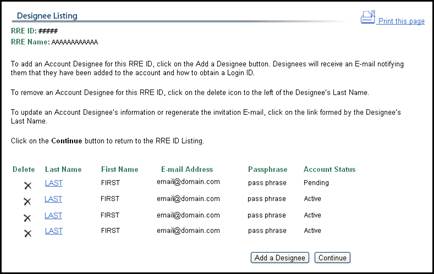

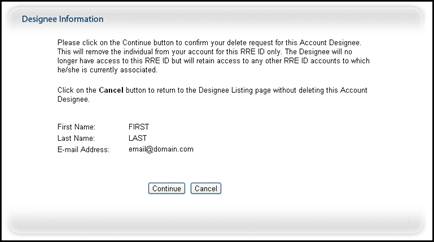

Chapter 9: Designee Maintenance

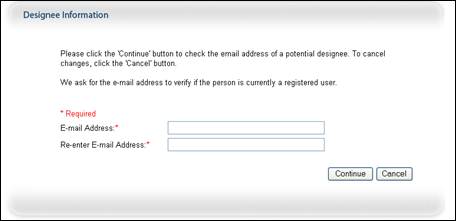

Add

an Existing User as a Designee

Chapter 10: Account Designee Registration

Chapter 11: Update RRE Profile Information

Chapter 12: Replace Account Manager

Chapter 13: Remove Access to RRE

Chapter 14: Upload Input Files Via HTTPS

Input

Submission File Overview

Threshold

and Severe File Submission Errors

Chapter 15: Monitor File Processing

Chapter 16: Download Response Files Via HTTPS

Chapter 17: Monitor Test File Processing

Chapter 18: View Account Activity History

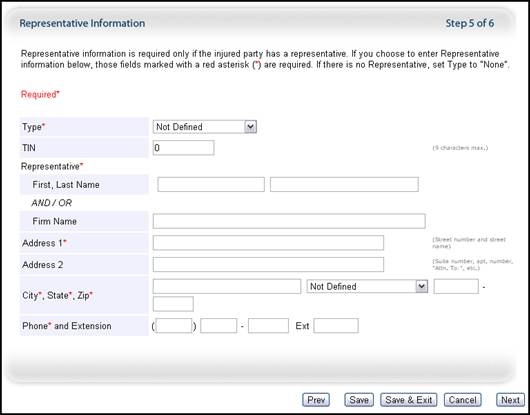

Representative

Information Page

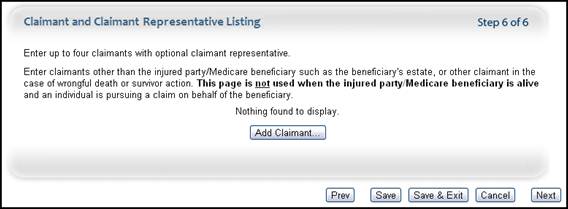

Claimant

and Claimant Representative Listing Page

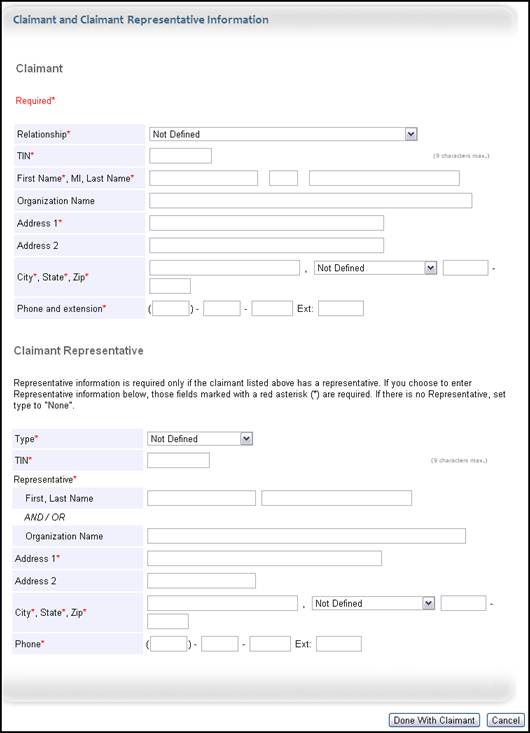

Claimant and

Claimant Representative Information Page

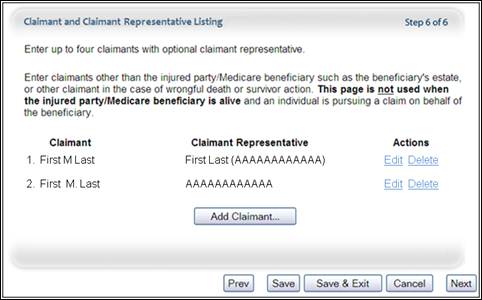

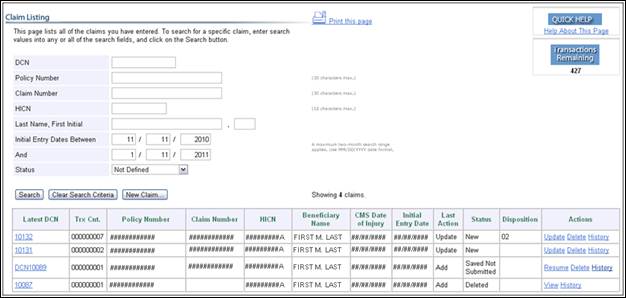

Resume

Claim Submission Process

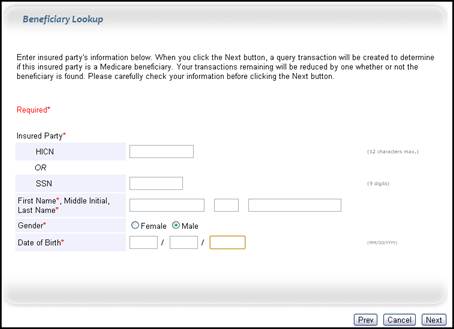

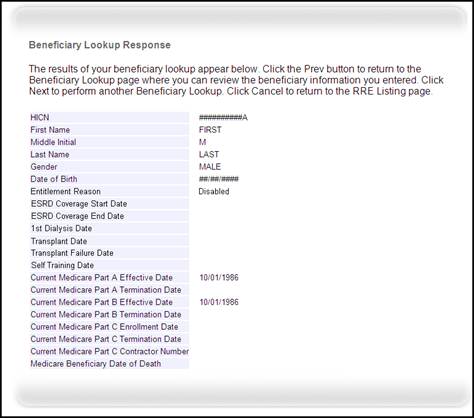

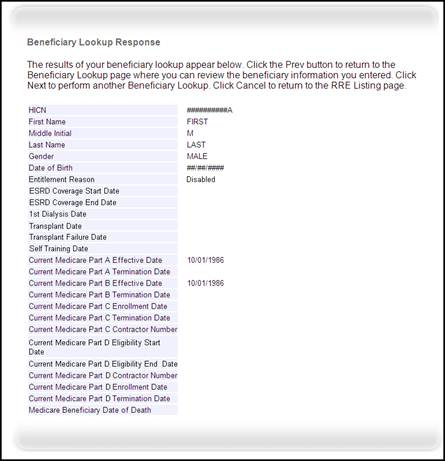

Chapter 22: Beneficiary Lookup

Account

Manager and Authorized Representative E-mail Addresses Match

Unsuccessful

Account Designee Registration

Account

Designee E-mail Address Matches Authorized Representative E-mail Address

Successful

Registration Letter

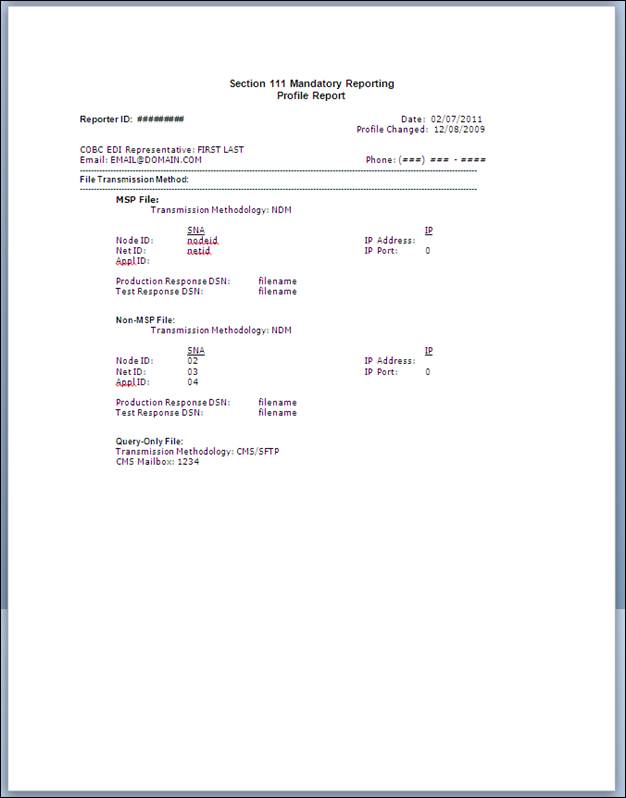

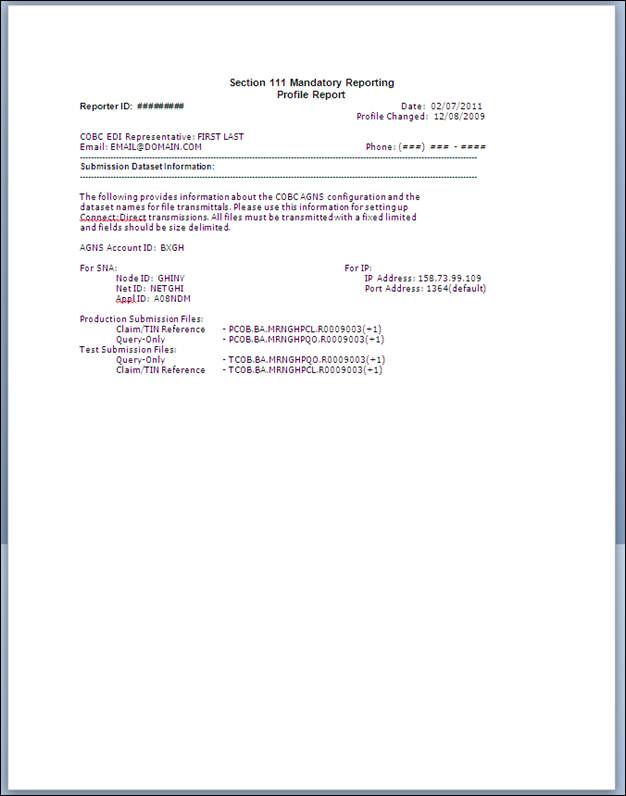

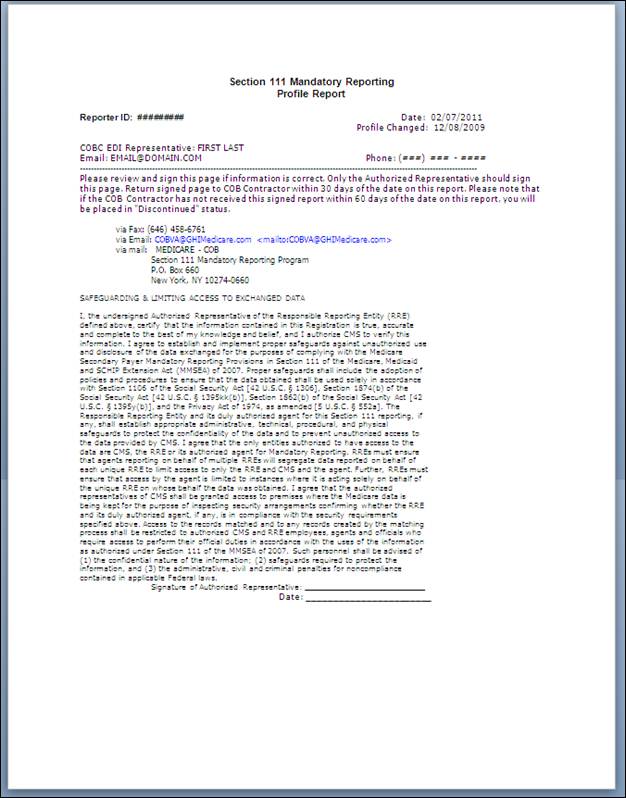

Profile

Report Email Notification

Non-Receipt

of Signed Profile Report Email Notification

Profile

Report Annual Recertification Email Notification

Non-Response

to Annual Recertification Email Notification

Successful

File Receipt Email Notification

Severe Error

Email Notification

Ready for

Testing Notification

Non-Attainment

of Production Status Email Notification

Ready for

Production Notification

Successful

File Processed Email Notification

Designee

Self-Revocation Notification

The following updates have been made in Version 7.1 of the Section 111 COBSW User Guide:

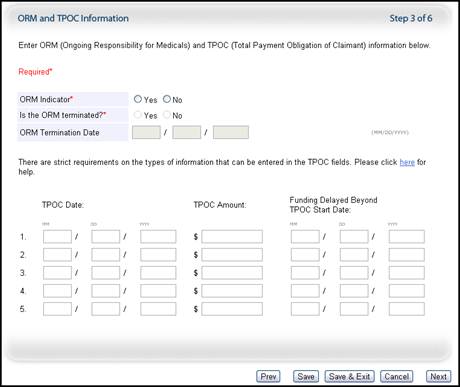

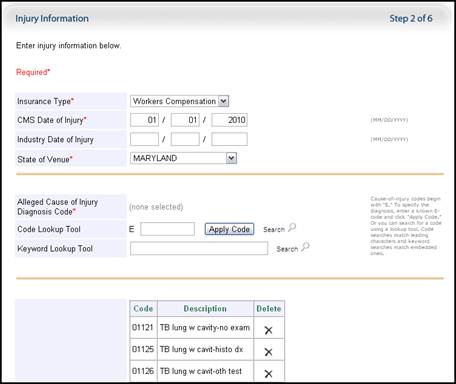

· The ORM and TPOC Information section has been updated as follows:

· Two tables summarizing the mandatory thresholds for liability insurance (including self-insurance) and workers’ compensation TPOC settlements, judgments awards or other payments were added to the description for TPOC Amount.

· A reminder instruction was added to explain the correct procedure for removing all previously reported TPOCs on a previously accepted Claim Record with no ORM (ORM Indicator = ‘N’).

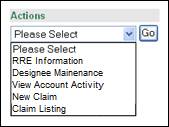

The Section 111 Coordination of Benefits Secure Web Site (COBSW) is a secure web application that provides a user interface for Section 111 Responsible Reporting Entities (RREs). The Section 111 COBSW is used by RREs and their agents to:

· Register the RRE and setup account reporting information

· Upload and download Section 111 files via the HTTPS file transfer method

· Monitor the results of test file submission

· Monitor the results of production file submission.

Section 111 of the Medicare, Medicaid, and SCHIP Extension Act of 2007 (MMSEA) amends the Medicare Secondary Payer (MSP) provisions of the Social Security Act to mandate entities that provide Group Health Plan (GHP), liability, no-fault, and workers’ compensation insurance to report information to Medicare for the purpose of coordinating benefits for Medicare beneficiaries. The provisions are to be implemented January 1, 2009 for GHP arrangements and July 1, 2009 for information about liability insurance, no-fault insurance, and workers’ compensation. The legislation requires insurers, third-party administrators, self-insured/administered entities, and applicable plan administrators or fiduciaries to report information to Medicare in the form and manner specified by the Secretary, DHHS. This new COB process is called the MMSEA Section 111 Reporting process.

This user guide was written to help the user understand the Section 111 COBSW and how to complete the registration and file submission processes.

All implementation instructions, including Mandatory Reporting User Guides containing file layouts, are available on the Section 111 dedicated Web page: http://www.cms.hhs.gov/MandatoryInsRep

The Section 111 COBSW permits multiple users per RRE to take part in the data exchange with the Coordination of Benefits Contractor (COBC). Each user will be defined with one of three possible roles.

The Authorized Representative (AR) is the individual in the RRE organization who has the legal authority to bind the organization to a contract and the terms of Section 111 requirements and processing. Your AR has ultimate accountability for the RRE’s compliance with Section 111 reporting requirements.

Although the AR does not have direct access to the Section 111 COBSW application and cannot be a user on the Section 111 COBSW, the AR must approve the RRE profile during the initial account setup and any subsequent changes. The AR is also the recipient of the more severe error notifications, such as missed quarterly file submissions. An AR cannot also be defined as an Account Manager (AM) or Account Designee (AD) for the RRE.

You may not change your Authorized Representative online after your registration has been processed. If you need to make a change later, you will have to contact your COBC EDI Representative.

If you are registering multiple RRE IDs, your Authorized Representative can be the same person for each or you may name a different person for each.

The AR:

· Designates the Account Manager, who registers the RRE and manages the file submission process.

· Must approve the account setup, by physically signing the Profile Report and returning to COBC.

· Cannot perform the role of an Account Manager (AM) or Account Designee (AD). This rule will be verified by defined E-mail addresses for the AR, AM, and AD.

· Cannot be an agent of the RRE.

Note: To initiate an Account Manager change, the AR must contact the EDI representative to invite the new AM.

The Account Manager (AM) is a user of the Section 111 COBSW who controls the administration of an RRE’s account, manages other users associated with the RRE ID and controls the overall reporting process. The AM may choose to manage the entire account and data file exchange, or may invite other company employees or data processing agents to assist. Each RRE ID can have only one Account Manager.

The AM:

· Must register on the Section 111 COBSW using the Personal Identification Number (PIN) issued by the COBC after the RRE ID has been registered in the New Registration step.

· Can be associated with more than one RRE ID if he has the authorized PIN from the COBC mailing for each.

· Can be an RRE employee or agent.

· Can invite other users to function as Account Designees (ADs).

· Manages the RRE’s profile, including selection of a file transfer method.

· Can upload and download files to the Section 111 COBSW if the RRE has specified HTTPS as the file transfer method.

· Can use his/her Login ID and Password to transmit files via the SFTP file transfer method.

· Can review file transmission history.

· Can review file-processing status and file statistics.

· Can remove an Account Designee’s association to an account.

· Can change account contact information (e.g. address, phone, etc.).

· Can change their personal information.

· Cannot be the Authorized Representative for any RRE ID.

· Cannot be an AD for the same RRE ID. This rule will be verified by defined E-mail addresses.

At the RRE’s discretion, an Account Manager for the RRE ID may invite other individuals to register as users of the COBSW associated with the RRE ID account known as Account Designees. Account Designees assist the Account Manager with the reporting process. Account Designees may be RRE employees or agents. There is no limit to the number of Account Designees associated with one RRE ID.

The Account Designee:

· Must register on the COBSW and obtain a Login ID.

· Can be associated with multiple RRE ID accounts, but only by an Account Manager invitation for each RRE ID.

· Can be an RRE employee or agent.

· Can upload and download files to the COBSW if the RRE has specified HTTPS as the file transfer method.

· Can use his/her Login ID and Password to transmit files if the RRE has specified SFTP as the file transfer method.

· Can review file transmission history.

· Can review file-processing statuses and file statistics.

· Can change his/her personal information on the COBSW.

· Cannot be an Authorized Representative for any RRE ID.

· Cannot be the Account Manager for the same RRE ID.

· Cannot invite other users to the RRE ID account.

· Cannot update RRE ID account information.

Each user of the Section 111 COBSW application will have only one Login ID and password. With that Login ID and password, you may be associated with multiple RRE IDs (RRE accounts). With one Login ID, you may be an Account Manager for one RRE ID and an Account Designee for another. In other words, the role you play on the COBSW is by RRE ID.

Users of the Section 111 COBSW may need assistance with managing an RRE account or with managing their personal information within the application. If necessary, users may contact their listed EDI Representative for such assistance. Each RRE is assigned an EDI Representative; however, any EDI Representative can assist a user. The name of their EDI Representative will be provided during RRE registration and will also be available on the RRE Information page during account setup. In addition, your EDI Representative Contact information is listed on your profile report which is sent to your Authorized Representative after the Account Setup is completed.

Contact your assigned EDI Representative directly via E-mail or phone using the contact information provided during registration and on your profile report. If you do not have this information or do not yet have an EDI Representative assigned, please contact the COBC EDI Department at 646-458-6740. EDI Representatives are available to assist you Monday through Friday, excluding Federal holidays, from 9:00 a.m. to 5:00 p.m. Eastern Time.

Contact your EDI Representative if:

· The RRE ID initial registration PIN letter is not received within 2 weeks (10 business days) after completing the New Registration step. The EDI Rep can resend the letter, allowing you to complete the RRE ID account setup.

· Any of the information entered during initial registration must be changed after the initial registration letter has been received.

· You have any questions or problems regarding the RRE ID account at any time during account setup.

· You forget your Login ID and cannot remember the answers to your Security Questions. The EDI Rep can resend your Login ID to your registered E-mail Address.

· You forget your Password and cannot remember the answers to your Security Questions. The EDI Rep can generate a temporary Password and send it to your registered E-mail Address.

· You incorrectly entered your PIN 3 times and locked the account. The EDI Representative can reset the PIN, unlocking the account.

· The File Transmission method must be changed for the RRE after the RRE account has been set up and the Profile Report has been sent.

· You uploaded a file in error. The EDI Rep can delete the erroneous file.

·

You have questions about file submission

errors or receive a notification from the COBC about a file threshold error.

The EDI Rep will work with you to understand the error, and determine whether

the file should be deleted and resubmitted or processed as submitted.

The Login page is the portal to the Section 111 COBSW for all Mandatory Reporting functions. Before the file submission process can begin, the following steps must be taken:

· The Responsible Reporting Entity (RRE) ID must be registered and Authorized Representative named by completing the New Registration step.

· The Account Manager must perform the Account Setup step for the RRE ID

· The Account Manager must self-register and obtain a Login ID

Once the RRE ID account and all users are registered, the Login page is used to log in to the Section 111 COBSW to manage the file submission process.

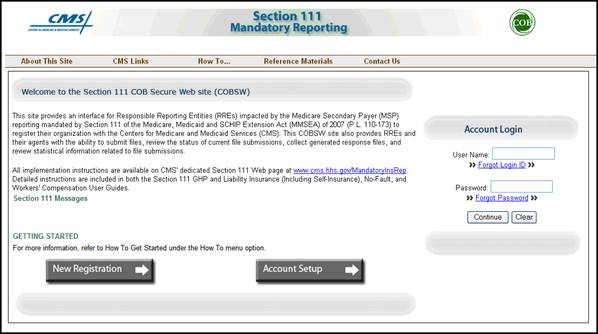

Figure 1: Login Page

The Section 111 Messages area of the Login page may contain important system messages.

Figure 2: Section 111 Messages

The navigation menu at the top of each page gives the user to access various parts of the CMS web site to facilitate using the Section 111 COBSW.

Figure

3: CMS Navigation Menu

· About This Site navigates to the How to Use This Site link, offering general information on how to use the Section 111 application.

·

CMS Links provides

links to the S111 dedicated Web page, the Medicare Website, and the

Coordination of Benefits Website.

·

How To provides

detailed information on performing the following functions:

· Getting Started

· Requesting your Login ID

· Requesting your Password

· Changing your Password

· Resetting your PIN

· Changing your Authorized Representative

· Changing your Account Manager

· Inviting Account Designees

· Changing your File Transmission Method

·

Reference Materials

provides links to the following, which offer detailed information pertaining to

the Section 111 COBSW:

· GHP User Guide

· Liability/No-Fault/Workers’ Compensation User Guide

· Test Beneficiary Data for NGHP RREs

· Excluded ICD-9 Diagnosis Code Data for NGHP RREs

· ICD-9 Diagnosis Codes

· Error Code Data for NGHP RREs

·

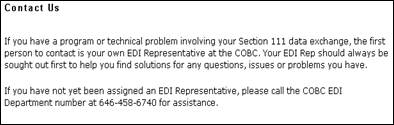

Contact Us

displays the following message:

Figure 4: Contact Us

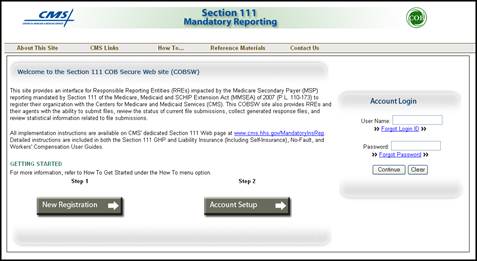

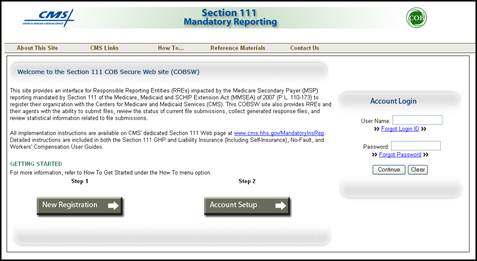

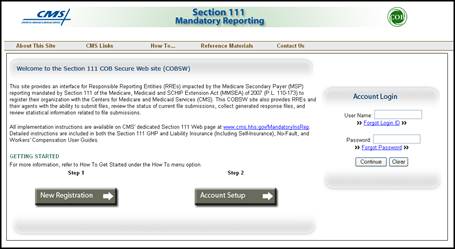

A company representative for the RRE must click on the New Registration button under Step 1, to complete and submit the registration information for each RRE ID needed. This step must be completed by the RRE, not an agent for the RRE. It is critical that you provide the Authorized Representative information (including e-mail address) in this New Registration step and not the email address for someone you want to be a user of the COBSW.

Depending on your reporting structure you may want to register more for more than one RRE ID. Refer to the How to Get Started section in the GHP User Guide to help determine how to decide the number of RRE IDs you will need.

Refer to Chapter 3 for more information on account registration.

Note:

Former GHP VDSA/VDEA partners who have already registered as Section 111 RREs

and were assigned RRE IDs prior to April 2009 will not need to perform this New

Registration step. Instead, the COBC will mail a PIN to your Authorized

Representative and your Account Manager will use that in

Step 2, Account Setup. Refer to Chapter 4 for more information.

After completion of the New Registration step, the COBC will mail a confirmation letter containing the RRE ID and PIN to the Authorized Representative, along with instructions for setting up the account. The assigned Account Manager should click the Account Setup button under Step 2 to finish the RRE ID account setup, and to register himself as the Account Manager. Refer to Chapter 4 for more information on account setup and AM registration.

After Account Managers and Account Designees have self-registered, and after Account Managers have completed the RRE Account setup process, AMs and ADs enter their Login IDs and Passwords in the Account Login fields to enter the Section 111 COBSW and manage the file submission process. Account Managers can also perform Account Designee maintenance. Refer to Chapter 9 for information on the AD self-registration process. Refer to Chapter 5 for more information about the Login process, including information on the Forgot Login ID and Forgot Password links on the Login page.

A Responsible Reporting Entity (RRE) is a plan or company that provides Group Health insurance, Liability insurance (including self-insurance), No-fault insurance, or Workers' Compensation plans. An RRE must be registered within the Section 111 COBSW to submit GHP coverage and Non-GHP (liability, no-fault, workers’ compensation) claim files.

Before beginning the registration process, an RRE must determine how the RRE will submit its Section 111 files to the COBC and how many Section 111 Reporter IDs (RRE IDs) will be needed. Only one GHP MSP Input File may be submitted on a quarterly basis for each GHP RRE ID. Liability Insurance/No-Fault Insurance/Workers’ Compensation RREs may only submit one Claim Input File for each RRE ID per quarter. Due to corporate organization, data processing system structures and agents that may be used for file submission, you may want to submit more than one Input File to the COBC on a quarterly basis and therefore need more than one RRE ID in order to do so.

For example, if an RRE will use one agent to submit one set of GHP coverage information and another agent to submit another set of GHP coverage information, the RRE must register on the COBSW twice to obtain two RRE IDs that will be used by each agent respectively. You may name the same Authorized Representative and Account Manager for both accounts or use different individuals. Likewise, if you have two or more subsidiary companies that handle different regions of the country (or different lines of business) using different data processing systems and you will not combine the quarterly Input Files for Section 111 reporting, you must register for each quarterly file submission to obtain separate RRE IDs in order to submit multiple Input Files in one quarter. Alternately, if you will submit only one Claim or MSP Input File per quarter, you will need only one RRE ID. Using the same RRE ID, one agent could submit your Claim or MSP Input Files and another agent could submit your Query Files. Please see the Section 111 User Guides for more information.

You may not set up a separate RRE ID for submission of the Query File or GHP Non-MSP Input File only. You must submit a quarterly GHP MSP Input File or liability/no-fault/workers’ compensation Claim Input File for every RRE ID you establish.

You must complete the New Registration step for every RRE ID you will use for Section 111 reporting.

It is critical that you provide accurate information on your Authorized Representative in this step, including his/her E-mail address.

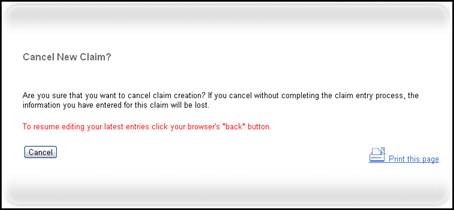

Before beginning the RRE ID registration, read this entire chapter and gather all the necessary information. Once you have started the registration process you must complete the registration. If you click Cancel and close the application at any point before RRE ID registration is complete, your changes will NOT be saved, and all entered data will be lost.

From the Login page, a company representative for the RRE must provide basic information related to the RRE ID to start the registration process:

· A Federal Tax Identification Number (TIN) for the RRE

· RRE Company name and address

· RRE Authorized Representative contact information (name, job title, address, e-mail address, phone)

· National Association of Insurance Commissioners (NAIC) company code, if applicable

· Reporter Type (GHP or Liability/No-Fault/Worker’s Compensation)

· Optional Subsidiary company information to be included in the file submission for the registration (names, TINs, NAIC company codes for the subsidiaries).

To successfully register the RRE ID, follow the steps outlined below.

1. Enter the following URL into your web browser: https://www.section111.cms.hhs.gov/MRA/

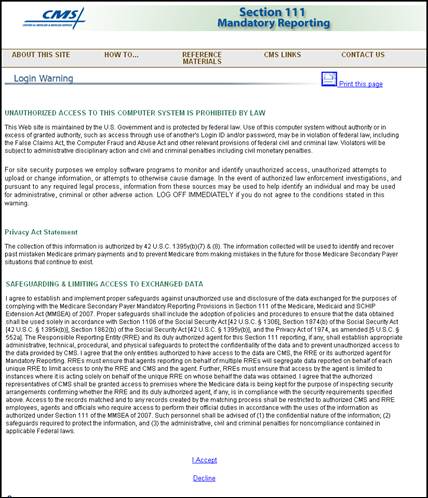

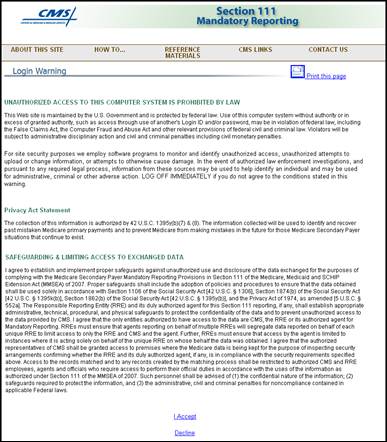

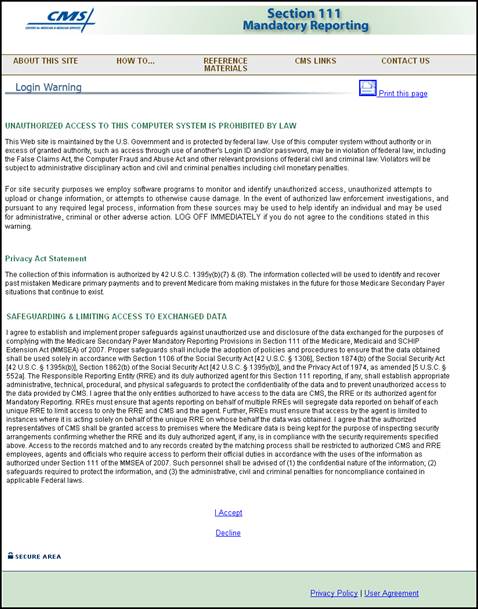

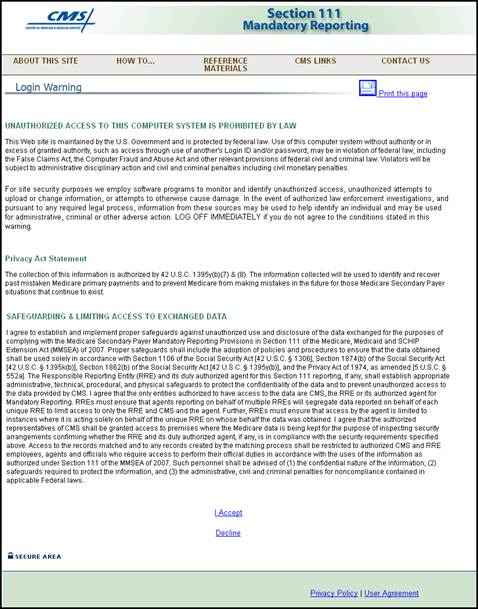

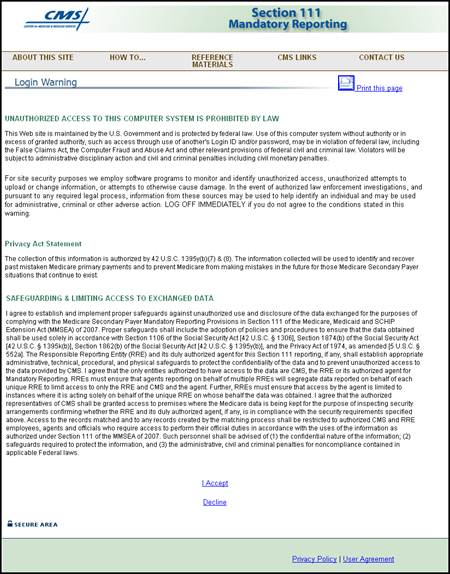

2. The Login Warning page displays, detailing the Data Use Agreement. The Login Warning page may be printed by clicking the Print this Page link in the upper right of the page.

Figure 5: Login Warning Page

3. Review the Data Use Agreement (DUA). All users must agree to similar language each time they log in to the Section 111 COBSW application. The DUA explains that data exchanged for Section 111 is to be used solely for the purposes of coordinating health care benefits for Medicare beneficiaries between Medicare and Section 111 RREs who provide other health insurance coverage. Measures must be taken by all involved parties to secure all data exchanged and ensure it is used properly.

4. To proceed, click the I Accept link.

5. The Section 111 Mandatory Reporting Login page displays.

Figure 6: S111 Mandatory Reporting Login Page

6. Click the New Registration link.

7. The Account Registration Information page displays. This page outlines the process of RRE initial registration, explaining that basic information about the RRE must be entered, including RRE Company name and the names of its subsidiary companies. The Account Registration Information page describes what happens after initial registration is complete; you will receive a letter with the RRE ID and PIN, which will be used by the Account Manager to complete the RRE ID Account setup. This page also describes the role of the Authorized Representative.

Figure 7: Account Registration Information Page

8. Read the overview and click Continue.

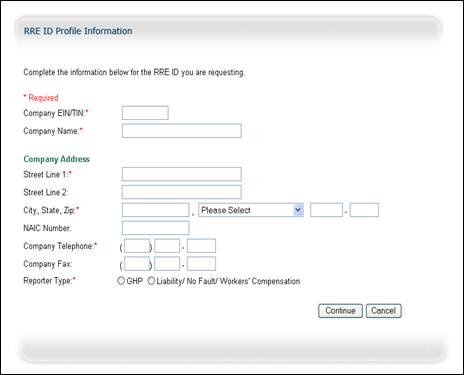

9. The RRE ID Profile Information page displays, requesting information related to the RRE, including Company Name, Address, EIN, NAIC Information, and Phone Number. The table below details the required information. Fields marked with an asterisk (*) are required.

Figure 8: RRE ID

Profile Information Page

Table 1: RRE ID Profile Information Page Field Descriptions

|

Field |

Description |

|

Company EIN/TIN |

The IRS-assigned employer identification number (EIN) or tax identification number (TIN) associated with the organization reflected under this Section 111 registration. If you have more than one TIN, you may submit this registration with any one of those TINs. If you will be requesting multiple RRE IDs, you may use the same TIN for each or different TINs. For foreign RREs, enter a pseudo-TIN, using the 9999xxxxx format, where xxxx is a 5-digit number created by the RRE. (Foreign RREs are those that have no IRS-assigned TIN and/or US mailing address. Guam, Puerto Rico, and the US Virgin Islands are NOT foreign RREs.) |

|

Company Name |

Company or Organization Name of the RRE |

|

Street Line 1 |

Line 1 of Street Address |

|

Street Line 2 |

Line 2 of Street Address (Optional) |

|

City, State, Zip |

Enter the City, select the State from the dropdown menu, and enter the Zip Code (Required) plus 4-digit Zip-code suffix (Optional) of the RRE For foreign RREs, select “Foreign Country” from the State dropdown menu. The rest of the address fields are not required. Note: To quickly select a state, type the first letter then hit Enter to scroll to the desired state. |

|

NAIC Number |

The 5-digit company code assigned to your company by the National Association of Insurance Commissioners (NAIC). If you are not registered with the NAIC, enter 00000. If you have more than one NAIC Company Code, you may submit this registration with any one of those NAIC Company Codes. |

|

Company Telephone |

Company Telephone Number Note: For foreign RREs, enter a United States telephone number, if applicable. |

|

Company Fax |

Company Fax Number |

|

Reporter Type |

Type of RRE. Select from GHP (Group Health Plan) or Liability/No-Fault/Workers’ Compensation Note: Separate registrations are required for GHP and Liability/No-Fault /Workers’ Compensation (Non-GHP) entities. |

Table 2: RRE ID Profile Information Page Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

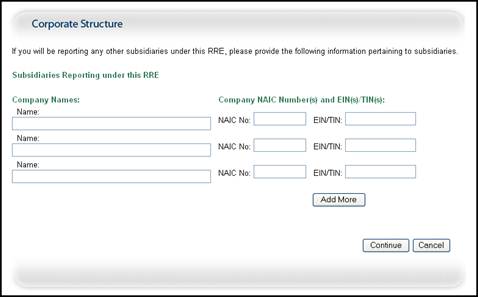

10. Enter the requested information then click the Continue button. The Corporate Structure page displays. This page is presented to capture information related to all subsidiary companies that will be reported under the registered RRE ID. This information will be used to ensure all RREs are properly reporting.

Figure 9: Corporate Structure Page

Table 3: Corporate Structure Page Field Descriptions

|

Field |

Description |

|

Company Names |

Supply the names of all the subsidiary companies reflected in this registration for which data will be submitted. |

|

Company NAIC Numbers(s) |

5-digit company code assigned to each subsidiary organization by the National Association of Insurance Commissioners (NAIC). If the subsidiary is not registered with the NAIC or if the NAIC number is unknown, enter 00000. |

|

EIN(s)/TIN(s) |

The IRS-assigned employer identification number (EIN) or tax identification number (TIN) associated each subsidiary company listed. You may use the same TIN entered for the RRE or different TINs. |

Table 4: Corporate Structure Page Command Buttons

|

Button |

Description |

|

Add More |

Click to add rows for additional subsidiary companies. |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

11. If subsidiary companies will be reporting under this RRE ID, those companies should be recorded. Subsidiaries separately incorporated or located in different states may be reported under one RRE ID.

12. Enter the following information for each subsidiary company of the RRE: Company Name, NAIC Number, and EIN/TIN, if applicable. To add additional subsidiaries, click the Add More button. Once all subsidiaries have been accounted for, click the Continue button.

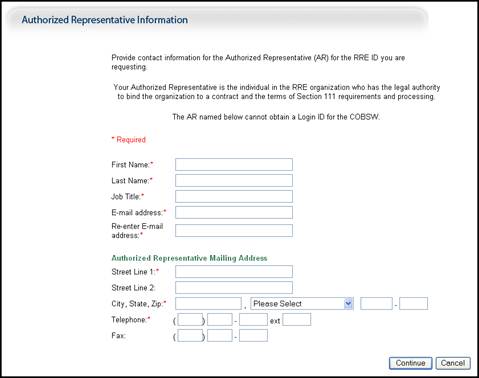

13. The Authorized Representative Information page displays. Enter the personal information for the Authorized Representative for the RRE ID. The AR:

· Is responsible for the proper and accurate reporting by the RRE.

· Will not be provided with a Login ID to access the Section 111 COBSW.

· Designates the Account Manager, who performs Account Setup for the RRE ID, manages users associated with the RRE ID account, and manages the file submission process.

· Must approve the account setup, by physically signing the Profile Report and returning to COBC.

· Cannot perform the role of an Account Manager (AM) or Account Designee (AD). This rule will be verified by defined E-mail addresses for the AR, AM, and AD.

Note: An Authorized Representative can only have that one role; the AR cannot function as an Account Manager or an Account Designee. E-mail addresses for each user role will be verified upon entry, and any address matches between AM, AD, and AR roles will be denied.

Figure 10: Authorized Representative Information Page

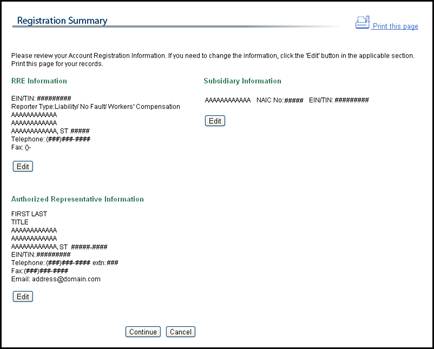

14. Enter the required information then click Continue. The Registration Summary page displays. This page lists all the information that was previously entered. All information should be reviewed and verified before continuing.

Figure 11: Registration Summary Page

15. Verify that all information is correct. To make any corrections, click the Edit button below the proper section to return to that section. Once all corrections have been made, click the Continue button on the Registration Summary page.

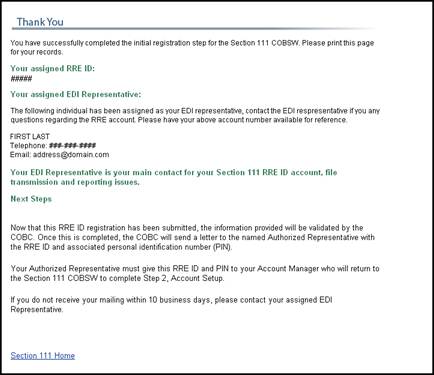

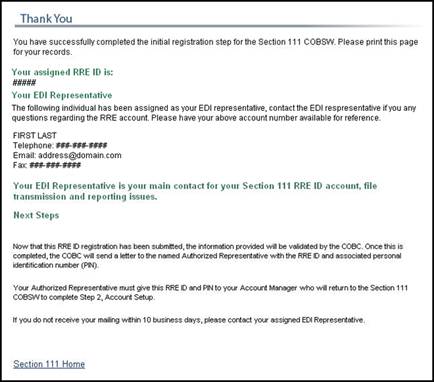

16. Once the RRE is registered, your RRE ID and EDI Representative will be listed on the Thank You page. Click the Section 111 Home link to return to the Login Warning page.

Figure 12: Registration Thank You Page

Within two weeks, a letter will be mailed to the Authorized Representative, containing the RRE ID and PIN, along with instructions for setting up the account (to be completed by the Account Manager). Refer to the Appendix for a sample mailing. If a letter is not received within 10 business days, contact your EDI Representative.

If you need more than one RRE ID for Section 111 reporting, each RRE must be registered separately. Return to the Section 111 homepage and click on New Registration to request an additional RRE ID.

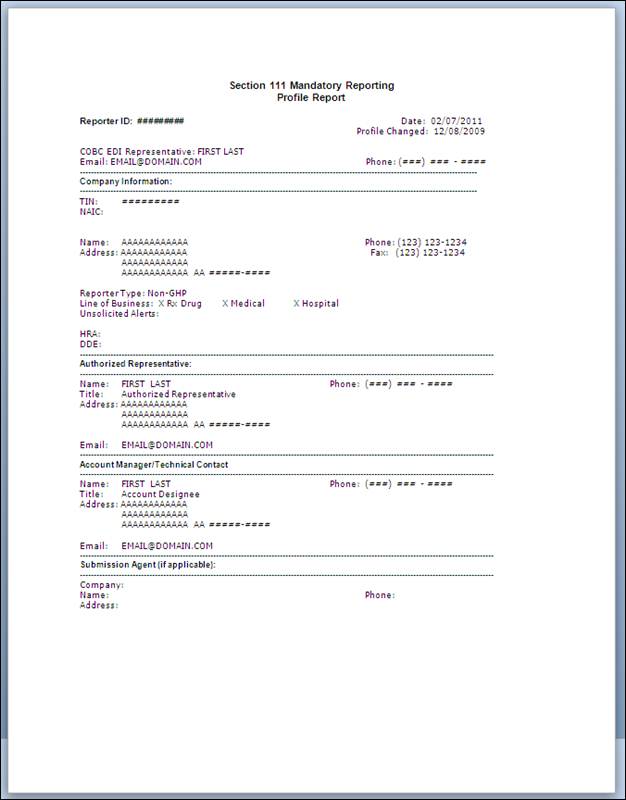

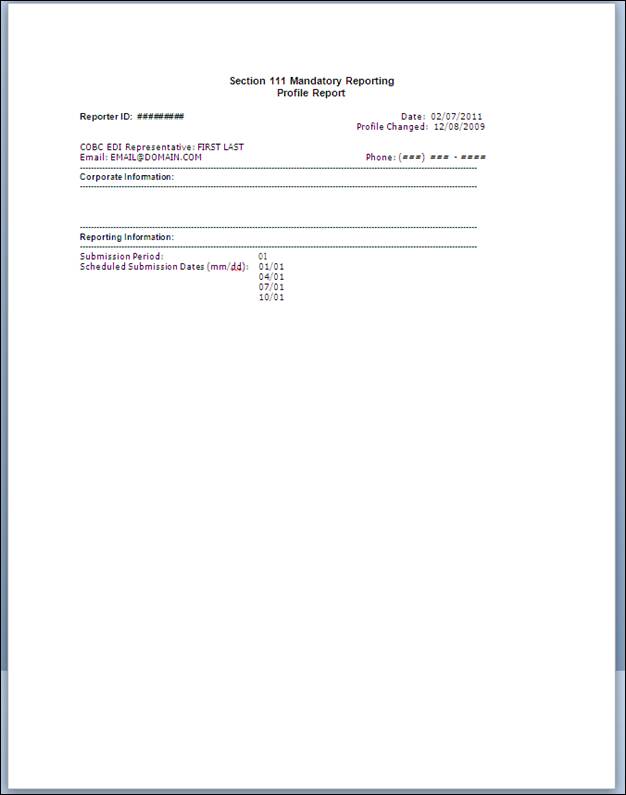

Once the Account Manager has completed the account setup, an E-mail notification will be sent to you, including a profile report denoting all information previously recorded during RRE registration, additional information provided during the account setup, and the RRE file submission period. Refer to the Appendix for a sample notification E-mail and Profile Report. Refer to Chapter 15 for more information on file submission timeframes. It may take up to 10 business days to receive the profile report.

You will have 30 calendar days to review, sign, and return the Profile Report to the COB contractor listed on the report. If a signed Profile Report is not received during that timeframe, an E-mail will be sent to you, indicating that a signed Profile Report must be received before testing can ensue. Refer to the Appendix for a sample E-mail.

Upon receipt of the mailed RRE ID and PIN, the Authorized Representative must provide the information to the designated Account Manager, who must then access the Section 111 COBSW to complete the account setup. The following section details the information to be entered by the Account Manager related to himself and the electronic file submission process for the RRE ID.

Contact your EDI representative if you any questions or problems regarding the RRE ID account at any time during RRE ID account setup.

To successfully set up the account and register yourself as the Account Manager, follow the steps outlined below.

1. Enter the following URL into your web browser: https://www.section111.cms.hhs.gov/MRA/

17. The Login Warning page displays, detailing the Data Use Agreement. The Login Warning page may be printed by clicking the Print this Page link in the upper right of the page.

Figure 13:

Login Warning Page

18. Review the Data Use Agreement (DUA). All users must agree to similar language each time they log in to the Section 111 COBSW application. The DUA explains that data exchanged for Section 111 is to be used solely for the purposes of coordinating health care benefits for Medicare beneficiaries between Medicare and Section 111 RREs who provide other health insurance coverage. Measures must be taken by all involved parties to secure all data exchanged and ensure it is used properly.

19. To proceed, click the I Accept link.

20. The Login page displays.

Figure 14: Login Page (Account Setup)

21. Click the Account Setup button.

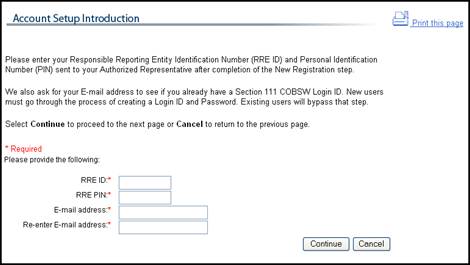

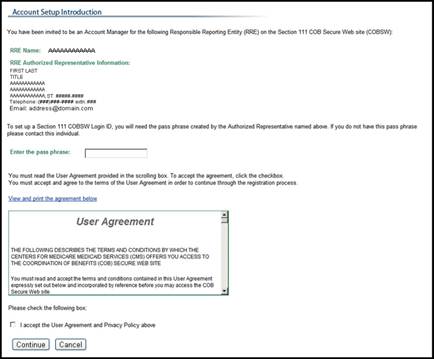

22. The Account Setup Introduction page displays. This page requires the entry of the RRE ID and PIN received from the mailing after registration.

Figure 15: Account Setup Introduction Page

23. Enter the RRE ID and PIN from the mailing forwarded to you by the Authorized Representative, and your E-mail Address then click Continue. Your E-mail address is needed to verify that you are a new user. If you have previously registered to use the Section 111 Web site (because you are a user for more than one RRE) you will not be prompted to create a new Login ID and Password. However, new users must go through the process of creating a new Login ID and Password during the RRE account setup.

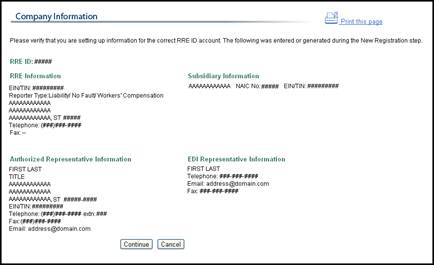

24. After all information has been entered and verified, the Company Information Confirmation page displays. The Company Information page displays all the information entered during the initial registration process.

Figure 16: Company Information Confirmation Page

25. Review the listed information and click the Continue button. If any of the listed information is incorrect, contact your EDI Representative to correct it.

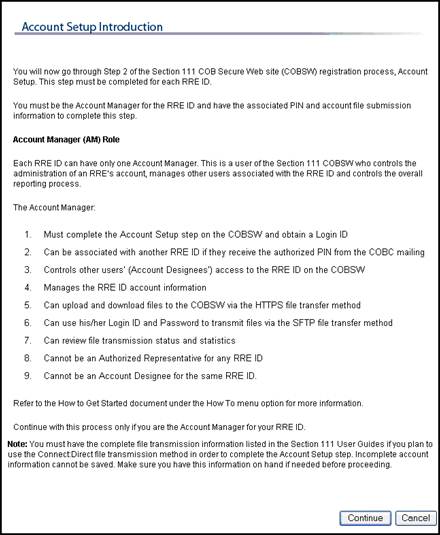

The Account Manager controls the administration of an RRE account. The AM has the following responsibilities:

· Must register on the Section 111 COBSW using the Personal Identification Number (PIN) issued by the COBC after the RRE ID has been registered in the New Registration step.

· Can be associated with more than one RRE ID if he has the authorized PIN from the COBC mailing for each.

· Can be an RRE employee or agent.

· Can invite other users to function as Account Designees (ADs).

· Manages the RRE’s profile, including selection of a claim submission method.

· Can upload and download files to the Section 111 COBSW if the RRE has specified HTTPS as the file transfer method.

· Can use his/her Login ID and Password to transmit files via the SFTP file transfer method.

· Can review file transmission history.

· Can review file-processing status and file statistics.

· Can remove an Account Designee’s association to an account.

· Can change account contact information (e.g. address, phone, etc.).

· Can change their personal information.

· Cannot be the Authorized Representative for any RRE ID.

· Cannot be an AD for the same RRE ID. This rule will be verified by defined E-mail addresses.

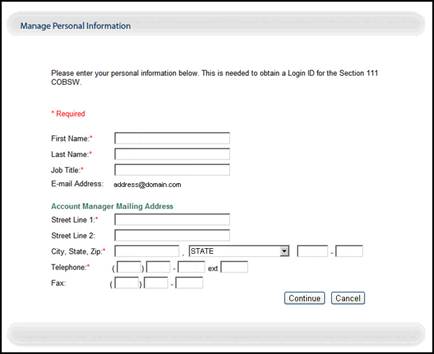

Your personal information must be entered at this point to register you as the Account Manager and provide access to the application.

1. The Account Setup Introduction page displays, with the Account Manager user role outlined, as well as an overview of the RRE Information entry process. Review the descriptions then click Continue.

Figure 17: Account Setup Introduction Page

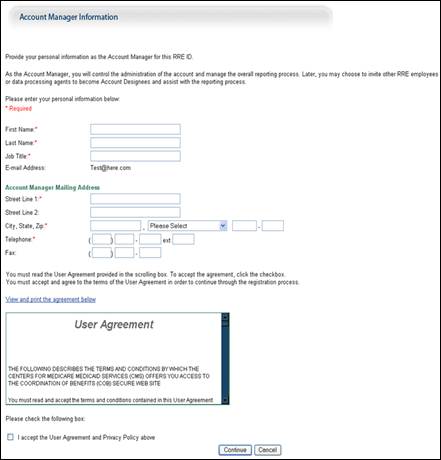

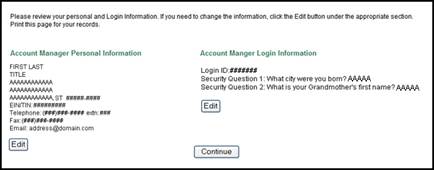

2. The Account Manager Personal Information page displays information regarding the Account Manager. The information is required for subsequent communications.

Figure 18: Account Manager Information Page

26. Enter

the required personal information, accept the User Agreement, and then click

Continue.

Note: You can register as an Account Manager for an RRE ID if

you are already a registered user. However, you cannot be an AM for any RRE if

you are an Authorized Representative. In addition, you cannot be an AM and an

Account Designee for that same RRE ID.

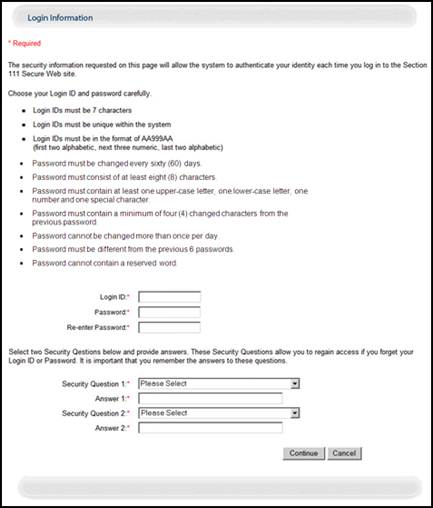

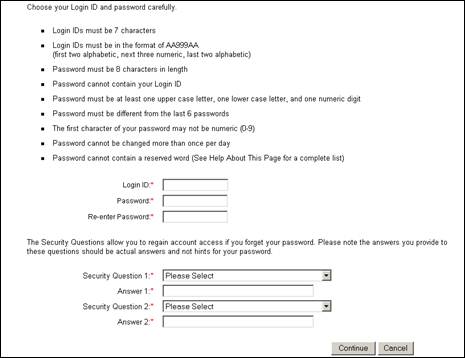

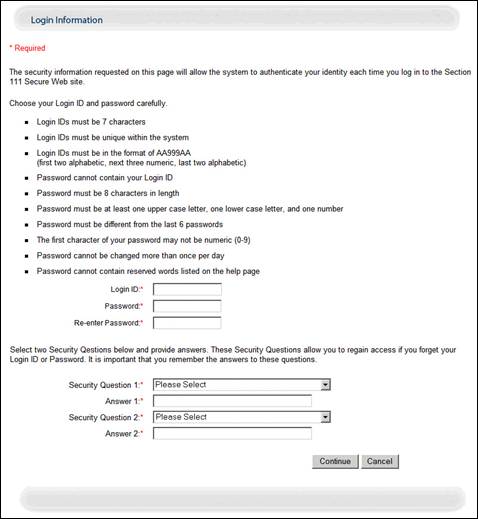

27. If you are a new user, the Account Manager Login Information page displays, requesting you to set up a Login ID and Password (using the following guidelines). Additionally, 2 security questions must be selected. Otherwise, this page is skipped.

· Login IDs must be 7 characters

·

Login IDs must be in the format of AA999AA

(first two alphabetic, next three numeric, last two alphabetic)

· Login ID and Password cannot be the same

· Password must be changed every sixty (60) days.

· Password must consist of at least eight (8) characters.

· Password must contain at least one upper-case letter, one lower-case letter, one number and one special character.

· Password must contain a minimum of four (4) changed characters from the previous password.

· Password cannot be changed more than once per day.

· Password must be different from the previous 6 passwords.

· Password cannot contain a reserved word.

Figure 19: Account Manager Login Information Page

28. Enter the requested information, select 2 Security Questions and Answers, and click the Continue button. You will use your Login ID and Password to enter the Section 111 Web site and manage the RRE account, manage Designees, and upload and download files. The Security Questions will allow you to access your Login ID and reset your Password in the event you forget either one.

The RRE account setup process continues after Account Manager self-registration.

Your RRE Company will be one of two Reporter Types: Group Health Plan (GHP) or Non-Group Health Plan (Non-GHP). GHPs are companies that provide Group Health Plan insurance, while Non-GHPs provide Liability, No-Fault, and/or Worker’s Compensation insurance. The following pages display based on the selections made by the Authorized Representative during the initial account registration.

1. After you complete self-registration, the RRE ID Profile Information page displays. The following table details the listed information and the required information to be entered. Fields marked with an asterisk (*) are required.

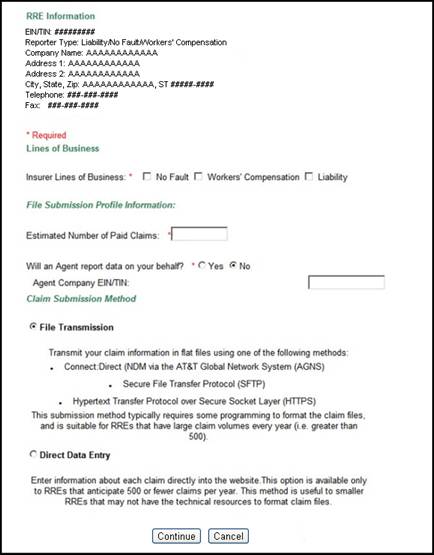

Figure 20: RRE ID Profile Information Page, Non-GHP

Table 5: Non-GHP RRE Information Page Field Descriptions

|

Field |

Description |

|

Company EIN/TIN |

The IRS-assigned employer identification number (EIN) or tax identification number (TIN) associated with the organization reflected under this Section 111 registration. If you have more than one TIN, you may submit this registration with any one of those TINs. If you will be requesting multiple RRE IDs, you may use the same TIN for each or different TINs. |

|

Company Name |

The company name associated with this Section 111 registration |

|

Reporter Type |

Type of Section 111 RRE Group Health Plan (GHP) or Liability / No-Fault / Workers' Compensation |

|

Address 1 |

Displays Line 1 of Street Address associated with this RRE |

|

Address 2 |

Displays Line 2 of Street Address, if applicable |

|

City, State, Zip |

Displays the City, State, and Zip Code plus 4-digit Zip-code suffix of the Company |

|

Telephone |

Displays Company Telephone Number |

|

Fax |

Displays Company Fax Number, if applicable |

|

Insurer Lines of Business checkboxes |

Select Insurer Line of Business. Options are No Fault, Workers’ Compensation, and Liability. Select all that are applicable. |

|

File Submission Profile Information |

Header description on page |

|

Estimated Number of Paid Claims |

The estimated number of paid claims per year |

|

Will an Agent report data on your behalf? radio buttons |

Select Yes if a Reporting Agent will be submitting data for the RRE. If not, select No. |

|

Agent Company EIN/TIN |

Employer Identification Number of the Reporting Agent Company; same as the Tax Identification Number. Required if Yes is selected for Reporting Agent radio button. |

|

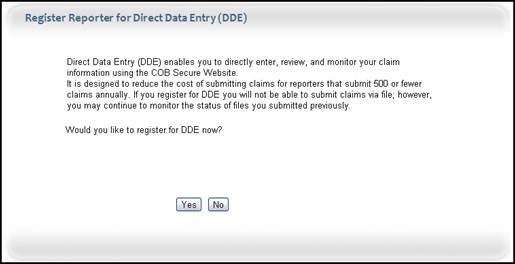

Claim Submission Method |

Select File Submission if you plan to create and submit your Claim and Query files using a flat file format via SFTP, HTTPS or Connect Direct. Select Direct Data Entry (DDE) to directly enter claim information on the website. This option is available to RREs who reported they plan to submit less than 500 claims per year. |

Table 6: Non-GHP RRE Information Page Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

2.

Enter the requested information and click Continue.

Note: If the Agent Company TIN is already registered, company

information will be pre-populated. The following pages to display depend on the

selections made under the Reporting Agent option on the RRE Information

page.

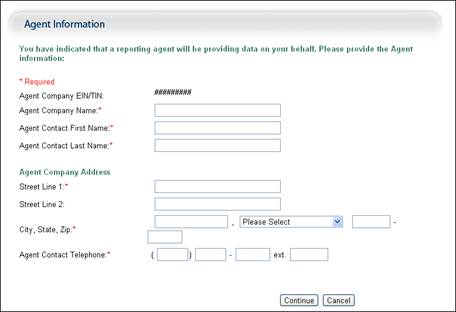

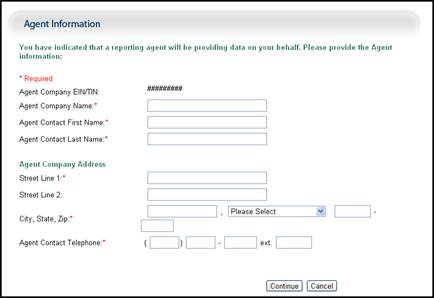

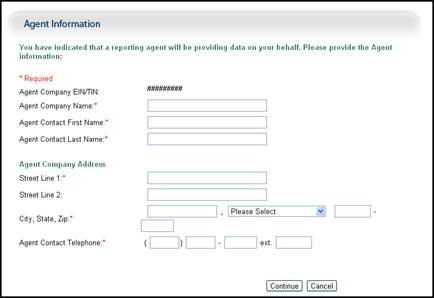

29. If a Reporting Agent will report data on behalf of the RRE, the Agent Information page displays. The table below details the required information. Fields marked with an asterisk (*) are required. Otherwise, this page is skipped.

Figure 21: Agent Information Page

Table 7: Agent Information Page Field Descriptions

|

Field |

Description |

|

Agent Company EIN/TIN |

Displays the Employer Identification Number of the Reporting Agent Company you entered on the RRE Info page. |

|

Agent Company Name |

Name of the Reporting Agent Company |

|

Agent Contact First Name |

First Name of Reporting Agent Contact |

|

Agent Contact Last Name |

Last Name of Reporting Agent Contact |

|

Agent Company Address |

Header description on page |

|

Street Line 1 |

Line 1 of Reporting Agent Street Address |

|

Street Line 2 |

Line 2 of Reporting Agent Street Address (Optional) |

|

City, State, Zip |

Enter the City, select the State from the dropdown menu, and enter the Zip Code (Required) plus 4-digit Zip-code suffix (Optional) of the Reporting Agent. For foreign RREs, select “Foreign Country” from the State dropdown menu. The rest of the address fields are not required. |

|

Agent Contact Telephone |

Reporting Agent Telephone Number Note: For foreign RREs, enter a United States telephone number, if applicable. |

Table 8: Agent Information Page Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

30. Enter the required information and click Continue.

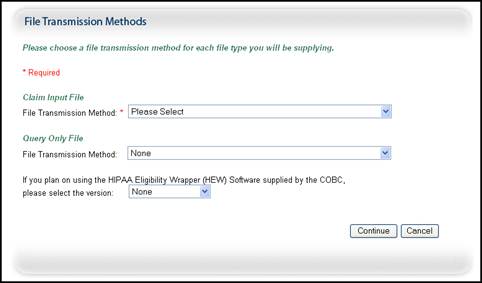

31. If the File Transmission option was selected for Claim Submission Method, the File Transmission Methods page displays next. If DDE was selected as the Claim Submission Method, the RRE Information Summary page displays next. The File Transmission Methods page allows you to select how RRE Claim Input files and Query-Only files will be submitted to the COBC. Response files will be sent from the COBC using the same methods. The following table details the required information. Fields marked with an asterisk (*) are required.

Figure 22: File Transmission Methods Page

Table 9: File Transmission Methods Field Descriptions

|

Field |

Description |

|

Claim Input File: File Transmission Method |

Select from Connect:Direct, SFTP, or HTTPS. |

|

Query-Only File: File Transmission Method |

Select from Connect:Direct, SFTP, or HTTPS. |

|

HEW Software Version |

Used for Query-Only files. Select from Mainframe or PC/Server Based. HEW software translates (wraps) the file into a HIPAA-compliant 270 eligibility query file format. The 270 format is created to transfer the file. The program also runs against the response file to put the file into a format that can be read (unwrapped) on your system. Contact your EDI Rep to request a copy of this software if you do not receive it by the time your RRE is approved for testing. |

Table 10: File Transmission Methods Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

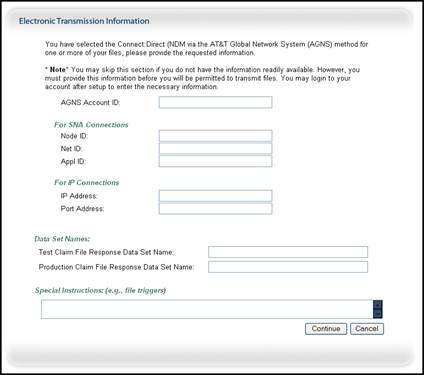

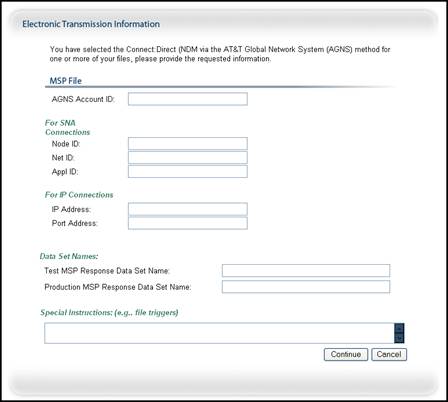

32. Enter the required information and click Continue. If Connect:Direct is chosen for any file transmission method, the Electronic Transmission Information page displays. Otherwise, this page is skipped. The following table details the required information. Note: Verify that the information entered is correct. Incorrect information will delay file submission.

Figure 23: Electronic Transmission Information Page

*Select either SNA Connections or IP Connections for connection information, whichever is applicable.

Table 11: Electronic Transmission Information Field Descriptions

|

Field |

Description |

|

AGNS Account ID |

AGNS Account ID. Used for file transmission via Direct:Connect through AGNS. The AGNS account should be set up well in advance of Section 111 registration and set up. Contact your IT department for more information. |

|

For SNA Connections* |

Header description on page |

|

Node ID |

Unique sting of characters that identifies the device or point on your network to which you connect. Contact your IT department for this information. |

|

Net ID |

Net ID. Contact your IT department for this information. |

|

Appl ID |

APPL ID. Contact your IT department for this information. |

|

For IP Connections* |

Header description on page |

|

IP Address |

Unique 32-bit address that specifies the location on the internet your file will be sent to/from. Ex: 32.83.179.56 Contact your IT department for this information. |

|

Port Address |

The number assigned to the program running in the destination computer. The number is used to link the incoming data to the correct application. Ex: Port 80 Contact your IT department for this information. |

|

Data Set Names |

Header description on page |

|

Test Claim File Response Data Set Name |

For Connect:Direct. Specify the dataset name. If you are using a generation data group (GDG) then place the characters (+1) at the end of your data set name. |

|

Production Claim File Response Data Set Name |

For Connect:Direct. Specify the dataset name. If you are using a generation data group (GDG) then place the characters (+1) at the end of your data set name. |

|

Special Instructions |

Enter any special instructions for file transmission to the COBC. |

Table 12: Electronic Transmission Information Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

33. Enter

the required information and click Continue.

NOTE: You must have complete file transmission information

available if the Connect:Direct method is selected or this step cannot be

completed and all the other data you provided will be lost.

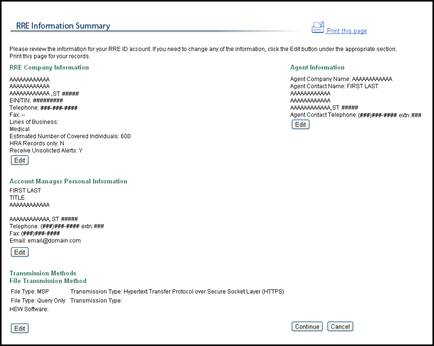

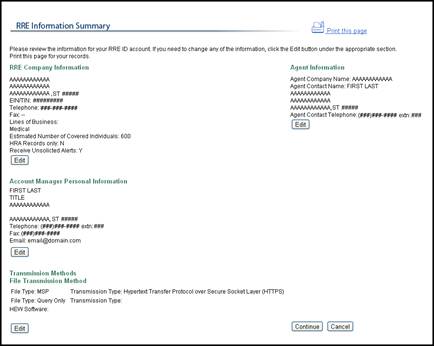

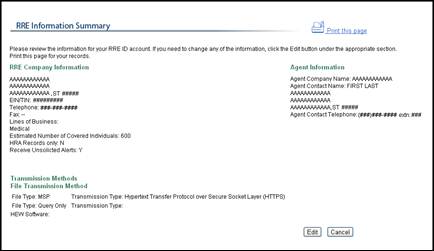

34. The RRE Information Summary page displays.

Figure 24: RRE Information Summary Page

35. Review the entered information. Click Edit under any section that must be corrected to return to that section. After all corrections have been made, click Continue on the RRE Information Summary page.

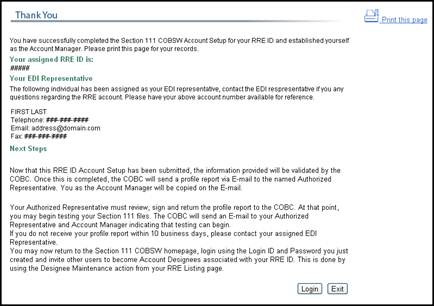

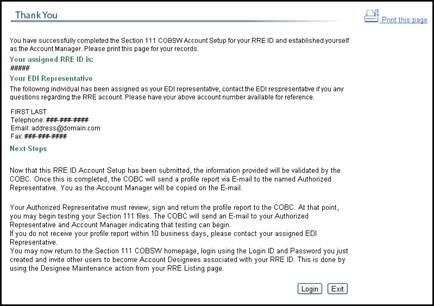

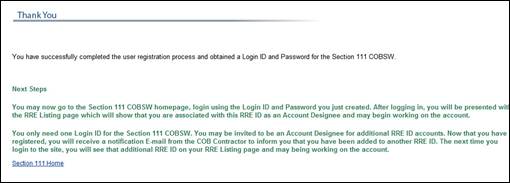

36. The Thank You page displays, describing the next steps in the process. It also re-lists your RRE ID and assigned EDI Representative. Click the Login button to return to the Login Warning page.

Figure 25: Thank You Page, Account Setup

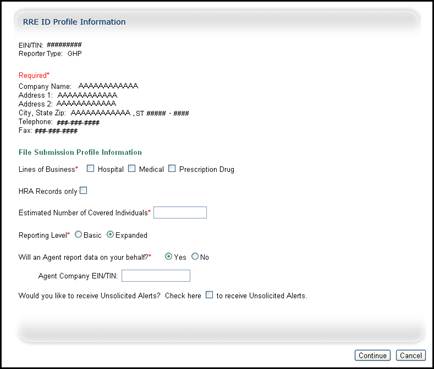

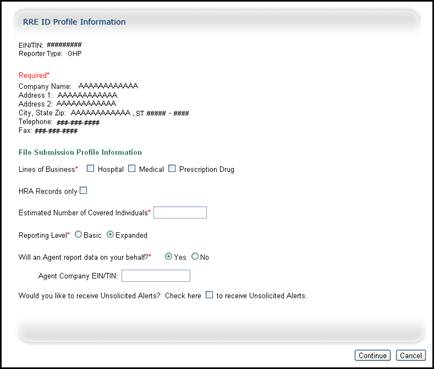

1. After you complete self-registration, the RRE ID Profile Information page displays. The following table details the listed information and the required information to be entered. Fields marked with an asterisk (*) are required.

Figure 26: RRE ID Profile Information Page

Table 13: GHP Basic RRE ID Profile Information Field Descriptions

|

Field |

Description |

|

Company EIN/TIN |

Displays Employer Identification Number; same as the Tax Identification Number |

|

Reporter Type |

Displays RRE Reporter Type. |

|

Company Name |

Displays Company Name of Insurer |

|

Address 1 |

Displays Line 1 of Street Address |

|

Address 2 |

Displays Line 2 of Street Address, if applicable |

|

City, State, Zip |

Displays the City, State, and Zip Code plus 4-digit Zip-code suffix of the Company |

|

Telephone |

Displays Company Telephone Number |

|

Fax |

Displays Company Fax Number, if applicable |

|

Insurer Lines of Business checkboxes |

Select Insurer Line of Business. Options are Hospital, Medical, and Prescription Drug. Select all that are applicable. |

|

HRA records only |

Check this box if the only records that will be submitted for this RRE will be for Health Reimbursement Accounts. (This option is for GHP RREs only. When checked, HRA records only = Y will display on the summary page). |

|

Estimated Number of Covered Individuals |

Estimated Number of Insured Individuals |

|

Reporting Level radio buttons |

Select Basic. Basic Responsible Reporters must provide hospital medical coverage that is primary to Medicare Part A and B. Basic Reporters can also process Query-only files. Insurers are required to submit an MSP file and the accompanying TIN Reference file on a quarterly basis. However, reporters can also submit Query-Only files as often as monthly. |

|

Will an Agent report data on your behalf? radio buttons |

Select Yes if a Reporting Agent will be submitting data for the RRE. If not, select No. Note: Aside from a separate agency, the Account Manager or Account Designee can also act as the Reporting Agent, although a Reporting Agent is not required. |

|

Agent Company EIN/TIN |

Employer Identification Number of the Reporting Agent Company; same as the Tax Identification Number. Required if Yes is selected for Reporting Agent radio button. |

|

Would you like to receive Unsolicited Alerts? check box |

Check the box to receive an Unsolicited Alerts file on a monthly basis. This file will alert the RRE to any changes to MSP occurrences that have been submitted. |

Table 14: GHP Basic RRE ID Profile Information Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

2.

Enter the requested information and click Continue.

Note: If the Agent Company TIN is already registered, company

information will be pre-populated. The following pages to display depend on the

selections made under the Reporting Level and Reporting Agent options on the RRE

Profile Information page.

37. If a Reporting Agent will report data on behalf of the RRE, the Agent Information page displays. The table below details the required information. Fields marked with an asterisk (*) are required. Otherwise, this page is skipped.

Figure 27: Agent Information Page

Table 15: Agent Information Page Field Descriptions

|

Field |

Description |

|

Agent Company EIN/TIN |

Displays the Employer Identification Number of the Reporting Agent Company you entered on the RRE Profile Info page. |

|

Agent Company Name |

Name of the Reporting Agent Company |

|

Agent Contact First Name |

First Name of Reporting Agent Contact |

|

Agent Contact Last Name |

Last Name of Reporting Agent Contact |

|

Agent Company Addresss |

Header description on page |

|

Street Line 1 |

Line 1 of Reporting Agent Street Address |

|

Street Line 2 |

Line 2 of Reporting Agent Street Address (Optional) |

|

City, State, Zip |

Enter the City, select the State from the dropdown menu, and enter the Zip Code (Required) plus 4-digit Zip-code suffix (Optional) of the Reporting Agent. For foreign RREs, select “Foreign Country” from the State dropdown menu. The rest of the address fields are not required. |

|

Agent Contact Telephone |

Reporting Agent Telephone Number Note: For foreign RREs, enter a United States telephone number, if applicable. |

Table 16: Agent Information Page Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

38. Enter the required information and click Continue.

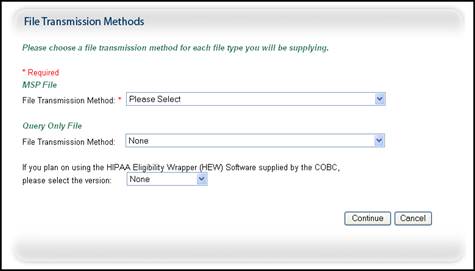

39. The File Transmission Methods page displays next. The table below details the required information. Fields marked with an asterisk (*) are required.

Figure 28: File Transmission Methods Page

Table 17: Basic Reporting Options Field Descriptions

|

Field |

Description |

|

MSP File Transmission Method |

Select from Connect:Direct, SFTP, or HTTPS. |

|

Query-Only File Transmission Method |

Select from Connect:Direct, SFTP, or HTTPS. |

|

HEW Software Version |

Used for Query-Only files. Select from Mainframe or PC/Server Based. HEW software translates (wraps) the file into a HIPAA-compliant 270 eligibility query file format. The 270 format is created to transfer the file. The program also runs against the response file to put the file into a format that can be read (unwrapped) on your system. Contact your EDI Rep to request a copy of this software if you do not receive it by the time your RRE is approved for testing. |

Table 18: Basic Reporting Options Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

40. Enter

the required information and click Continue. If

Connect:Direct is chosen for any file transmission method, the Electronic

Transmission Information page displays. Otherwise, this page is skipped.

The following table details the required information. Note:

Verify that the information entered is correct. Incorrect information will

delay file submission.

Figure 29: Electronic Transmission Information Page

*Select either SNA Connections OR IP Connections for connection information, whichever is applicable.

Table 19: Electronic Transmission Information Field Descriptions

|

Field |

Description |

|

AGNS Account ID |

AGNS Account ID. Used for file transmission via Direct:Connect through AGNS. The AGNS account should be set up well in advance of Section 111 registration and set up. Contact your IT department for more information. |

|

For SNA Connections* |

Header description on page |

|

Node ID |

Unique sting of characters that identifies the device or point on your network to which you connect. Contact your IT department for this information. |

|

Net ID |

Net ID. Contact your IT department for this information. |

|

Appl ID |

APPLI ID. Contact your IT department for this information. |

|

For IP Connections* |

Header description on page |

|

IP Address |

Unique 32-bit address that specifies the location on the internet your file will be sent to/from. Ex: 32.83.179.56 Contact your IT department for this information. |

|

Port Address |

The number assigned to the program running in the destination computer. The number is used to link the incoming data to the correct application. Ex: Port 80 Contact your IT department for this information. |

|

Data Set Names |

Header description on page |

|

Test MSP Response Data Set Name |

For Connect:Direct. Specify the dataset name. If you are using a generation data group (GDG) then place the characters (+1) at the end of your data set name. |

|

Production MSP Response Data Set Name |

For Connect:Direct. Specify the dataset name. If you are using a generation data group (GDG) then place the characters (+1) at the end of your data set name. |

|

Special Instructions |

Enter any special instructions for file transmission to the COBC. |

Table 20: Electronic Transmission Information Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

41. Enter

the required information and click Continue. Note:

You must have the complete file transmission information available if the

Connect:Direct method is selected, or this step cannot be completed and all

other data you provided will be lost.

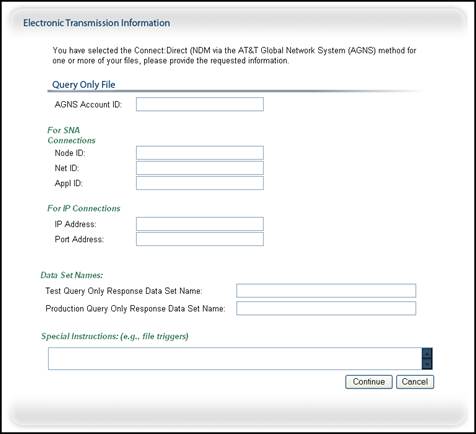

42. The

Query Only File screen of the Electronic Transmission page

displays if you selected Connect:Direct as a file transmission option for

Query-Only files. This screen requests the same information as the prior

screen, except for Query-Only files as opposed to MSP files.

Note: You must have complete file transmission information

available if the Connect:Direct method is selected or this step cannot be

completed and all the other data you provided will be lost.

Figure 30: Electronic Transmission Page, Query-Only Screen

43. Enter the required information and click Continue.

44. The RRE Information Summary page displays.

Figure 31: RRE Information Summary

45. Review the entered information. Click Edit under any section that must be corrected to return to that section. After all corrections have been made, click Continue on the RRE Information Summary page.

46. The Thank You page displays, describing the next steps in the process. It also re-lists your RRE ID and assigned EDI Representative. Click the Login button to return to the Login Warning page.

Figure 32: Thank You Page, RRE ID

1. After you complete self-registration, the Responsible Reporting Entity Information page displays. The following table details the listed information and the required information to be entered. Fields marked with an asterisk (*) are required.

Figure 33: RRE ID Profile Information Page

Table 21: RRE ID Profile Information Field Descriptions

|

Field |

Description |

|

Company EIN/TIN |

Displays Employer Identification Number; same as the Tax Identification Number |

|

Company Name |

Displays Company Name of Insurer |

|

Reporter Type |

Displays RRE Reporter Type. |

|

Address 1 |

Displays Line 1 of Street Address |

|

Address 2 |

Displays Line 2 of Street Address, if applicable |

|

City, State, Zip |

Displays the City, State, and Zip Code plus 4-digit Zip-code suffix of the Company |

|

Telephone |

Displays Company Telephone Number |

|

Fax |

Displays Company Fax Number, if applicable |

|

Insurer Lines of Business checkboxes |

Select Insurer Line of Business. Options are Hospital, Medical, and Prescription Drug. Select all that are applicable. |

|

HRA records only |

Check this box if the only records that will be submitted for this RRE will be for Health Reimbursement Accounts. (This option is for GHP RREs only. When checked, HRA records only = Y will display on the summary page). |

|

Estimated Number of Covered Individuals |

Estimated Number of Insured Individuals |

|

Reporting Level radio buttons |

Select Expanded. Expanded Responsible Reporters must provide hospital medical coverage that is primary to Medicare Part A and B. Reporters can also process Query-only files. Expanded Reporters must also provide other health insurance (OHI) information related to the covered individual’s Part D enrollment (prescription drug plan).Expanded reporters’ query files can receive Parts A, B, and D entitlement information. (Part D information is supplied only if the reporter has submitted OHI). Insurers are required to submit an MSP file and the accompanying TIN Reference file on a quarterly basis. However, Expanded reporters can also submit non-MSP and Query-Only files as often as monthly. |

|

Will an Agent report data on your behalf? radio buttons |

Select Yes if a Reporting Agent will be submitting data for the RRE. If not, select No. Note: Aside from a separate agency, the Account Manager or Account Designee can also act as the Reporting Agent, although a Reporting Agent is not required. |

|

Agent Company EIN/TIN |

Employer Identification Number of the Reporting Agent Company; same as the Tax Identification Number. Required if Yes is selected for Reporting Agent radio button. |

|

Would you like to receive Unsolicited Alerts? check box |

Check the box to receive an Unsolicited Alerts file on a monthly basis. This file will alert the RRE to any changes to MSP occurrences that have been submitted. |

Table 22: RRE ID Profile Information Page Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

2.

Enter the requested information and click Continue.

Note: If the Agent Company TIN is already registered, company

information will be pre-populated. The following pages to display depend on the

selections made under the Reporting Level and Reporting Agent options on the RRE

Information page.

47. If a Reporting Agent will report data on behalf of the RRE, the Agent Information page displays. Otherwise, this page is skipped. The table below details the required information. Fields marked with an asterisk (*) are required.

Figure 34: Agent Information Page

Table 23: Agent Information Page Field Descriptions

|

Field |

Description |

|

Agent Company EIN/TIN |

Displays the Employer Identification Number of the Reporting Agent Company you entered on the RRE Info page. |

|

Agent Company Name |

Name of the Reporting Agent Company |

|

Agent Contact First Name |

First Name of Reporting Agent Contact |

|

Agent Contact Last Name |

Last Name of Reporting Agent Contact |

|

Agent Company Address |

Header description on screen |

|

Street Line 1 |

Line 1 of Reporting Agent Street Address |

|

Street Line 2 |

Line 2 of Reporting Agent Street Address (Optional) |

|

City, State, Zip |

Enter the City, select the State from the dropdown menu, and enter the Zip Code (Required) plus 4-digit Zip-code suffix (Optional) of the Reporting Agent For foreign RREs, select “Foreign Country” from the State dropdown menu. The rest of the address fields are not required. |

|

Agent Contact Telephone |

Reporting Agent Telephone Number Note: For foreign RREs, enter a United States telephone number, if applicable. |

Table 24: Agent Information Page Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

48. Enter the required information and click Continue.

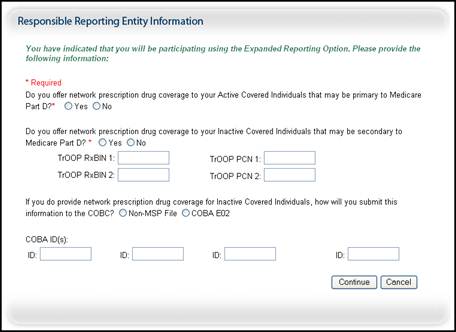

49. The Expanded Reporting Option page displays (The Expanded option is only available to GHP reporters). The table below details the required information. Fields marked with an asterisk (*) are required. Otherwise, this page is skipped.

Figure 35: Expanded Reporting Option Page

Table 25: Expanded Reporting Option Page Field Descriptions

|

Field |

Description |

|

Drug Prescription Coverage/ Active Covered Individuals radio buttons |

If your RRE offers network prescription drug coverage that may be primary to Part D coverage to Active Covered Individuals, select Yes. Otherwise, select No. |

|

Drug Prescription Coverage/ Inactive Covered Individuals radio buttons |

If your RRE offers network prescription drug coverage that may be secondary to Part D coverage to Inactive Covered Individuals, select Yes. Otherwise, select No. |

|

TrOOP Rx BIN 1 |

Prescription Drug Benefit Identification Number If you checked Yes to the question above, provide your RxBIN for this supplemental drug network coverage. |

|

TrOOP PCN 1 |

Prescription Drug Processor Control Number. If you checked Yes to the question above, provide your RxBIN for this supplemental drug network coverage. |

|

TrOOP Rx BIN 2 |

Additional Rx Benefit Identification Number. For use when reporting Supplemental Rx Coverage. Provide if you have more than one RX BIN for supplemental Rx coverage. |

|

TrOOP PCN 2 |

Additional Prescription Drug Processor Control Number. For use when reporting Supplemental Rx Coverage. Provide if you have more than one Rx PCN for supplemental Rx coverage. |

|

Drug Coverage Information Submission radio buttons |

If supplemental network drug coverage is provided to INACTIVE covered individuals, choose a submission method to indicate how this information will be supplied to the COBC. Select Non-MSP File or COBA E02 |

|

COBA ID(s) |

Coordination of Benefits Agreement ID numbers associated with the RRE. Required if the COBA E02 method of reporting was selected. |

Table 26: Expanded Reporting Option Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

50. Enter the required information and click Continue.

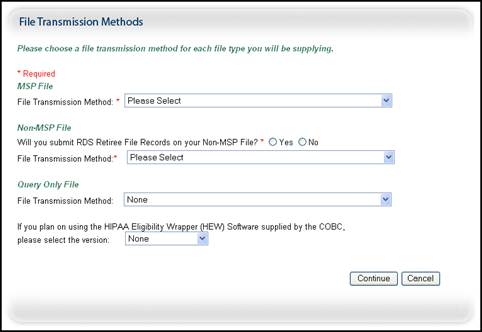

51. The File Transmission Methods page displays. The table below details the required information. Fields marked with an asterisk (*) are required.

Figure 36: File Transmission Methods Page

Table 27: File Transmission Methods Page Field Descriptions

|

Field |

Description |

|

MSP File Transmission Method |

Select from Connect:Direct, SFTP, or HTTPS. |

|

Non-MSP File RDS radio button |

If you will be submitting RDS Retiree File Records with the Non-MSP File, select Yes. |

|

Non-MSP File Transmission Method |

Select from Connect:Direct, SFTP, or HTTPS |

|

Query-Only File Transmission Method |

Select from Connect:Direct, SFTP, or HTTPS. |

|

HEW Software Version |

Used for Query-Only files. Select from Mainframe or PC/Server Based. HEW software translates (wraps) the file into a HIPAA-compliant 270 eligibility query file format. The 270 format is created to transfer the file. The program also runs against the response file to put the file into a format that can be read (unwrapped) on your system. Contact your EDI Rep to request a copy of this software if you do not receive it by the time your RRE is approved for testing. |

Table 28: File Transmission Methods Page Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

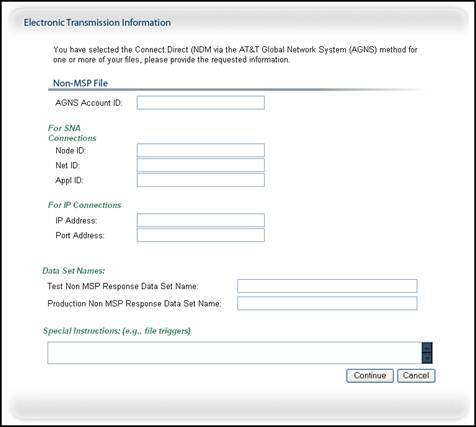

52. Enter the required information and click Continue. If Connect:Direct is chosen for any file transmission method, the Electronic Transmission Information page displays for each transmission type, MSP, Non-MSP, and Query-Only. Otherwise, this page is skipped. The following table details the required information. Note: Verify that the information entered is correct. Incorrect information will delay file submission.

Figure 37: Electronic Transmission Information Page, MSP

Table 29: MSP Electronic Transmission Information Page Field Descriptions

|

Field |

Description |

|

AGNS Account ID |

AGNS Account ID. Used for file transmission via Direct:Connect through AGNS. The AGNS account must be set up well in advance of Section 111 registration and set up. Contact your IT department for more information. |

|

For SNA Connections |

Header description on page |

|

Node ID |

Unique sting of characters that identifies the device or point on your network to which you connect. Contact your IT department for this information. |

|

Net ID |

Net ID. Contact your IT department for this information. |

|

Appl ID |

APPLI ID. Contact your IT department for this information. |

|

For IP Connections |

Header description on page |

|

IP Address |

Unique 32-bit address that specifies the location on the internet your file will be sent to/from. Ex: 32.83.179.56 Contact your IT department for this information. |

|

Port Address |

The number assigned to the program running in the

destination computer. The number is used to link the incoming data to the

correct application. Ex: Port 80 Contact your IT department for this information. |

|

Data Set Names |

Header description on page |

|

Test MSP Response Data Set Name |

For Connect:Direct. Specify the dataset name. If you are

using a generation data group (GDG) then place the characters (+1) at the end

of your data set name. |

|

Production MSP Response Data Set Name |

For Connect:Direct. Specify the dataset name. If you are

using a generation data group (GDG) then place the characters (+1) at the end

of your data set name. |

|

Special Instructions |

Enter any special instructions for file transmission to

the COBC. |

Table 30: MSP Electronic Transmission Information Page Command Buttons

|

Button |

Description |

|

Continue |

Click to save changes and continue to the next screen. |

|

Cancel |

Click to return to the previous page. Information entered on the current page is NOT saved. |

53. Enter

the required information for each transmission type and click Continue.

Note: You must have complete file transmission information

available if the Connect:Direct method is selected or this step cannot be

completed and all the other data you provided will be lost.

54. The RRE

Information Summary page displays.

Figure 38: RRE Information Summary Page

55. Review the entered information. Click Edit under any section that must be corrected to return to that section. After all corrections have been made, click Continue on the RRE Information Summary page.

56. The Thank You page displays, describing the next steps in the process. It also re-lists your RRE ID and assigned EDI Representative. Click the Login button to return to the Login Warning page.

Figure 39: Thank You Page

You have successfully set up the RRE account and yourself as the Account Manager. As the AM, you control the administration of the responsible reporting entity's account. Once you log in to the account, you will be able to maintain RRE information (Name, Address, Contact Information), upload and download files via HTTPS, monitor file processing, and review prior file processing results.

You may choose to manage the entire account and data file exchange, or you may invite other company employees or data processing agents to assist as Account Designees. Each RRE may have only one Account Manager. All Account Managers and their Account Designees will be authenticated prior to being added to the account.

To add Designees to the RRE account, you must login to the Section 111 Web site using the Login ID and Password you created during the Account Setup process. Chapter 8 describes the steps you must take as the Account Manager to invite users to be Account Designees. Chapter 9 details the Account Designee self-registration process once he has received an invitation E-mail from the COBC after you add him to your account, in the event that an AD is assigned to help the Account Manager with the file submission process.

Upon completion of all information for the account setup, an E-mail notification will be sent to the Authorized Representative. The E-mail will also include a profile report noting all information previously recorded during RRE registration, additional information provided during the account setup, and the RRE file submission period (if you selected the Direct Data Entry method, you will not be assigned a submission period). Refer to the Appendix for a sample notification E-mail and Profile Report. Refer to Chapter 15 for more information on file submission timeframes. It may take up to 10 business days to receive the profile report.

The Authorized Representative will have 30 calendar days to review, sign, and return the Profile Report to the COB contractor listed on the report. If a signed profile report is not received during that timeframe, an E-mail will be sent to the Authorized Representative, indicating that a signed Profile Report must be received before testing can ensue. Refer to the Appendix for a sample E-mail.

For RREs using a file submission method: Upon verification of profile information and physical setup of the file transmission, an E-mail will be sent by the COBC to the Authorized Representative and Account Manager to notify them of the change in status to “Testing.” At that point the RRE may begin test file submissions. Refer to the Appendix for a sample E-mail.

RREs using the Direct Data Entry Method: Upon verification of profile information, the RRE may begin entering claims on the COBSW.

1. Enter the following URL into your web browser: https://www.section111.cms.hhs.gov/MRA/

2. The Login Warning page displays, detailing the Data Use Agreement. The Login Warning page may be printed by clicking the Print this Page link in the upper right of the page.

Figure 40: Login Warning Page

57. Review the DUA. To proceed, click the I Accept link.

58. The Section 111 Mandatory Reporting Login page displays.

Figure 41: Login Page

59. Enter your Login ID in the User Name field and your Password in the Password field, and click Login.

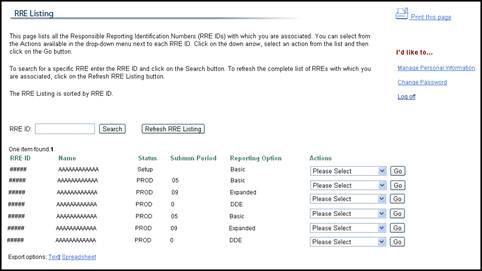

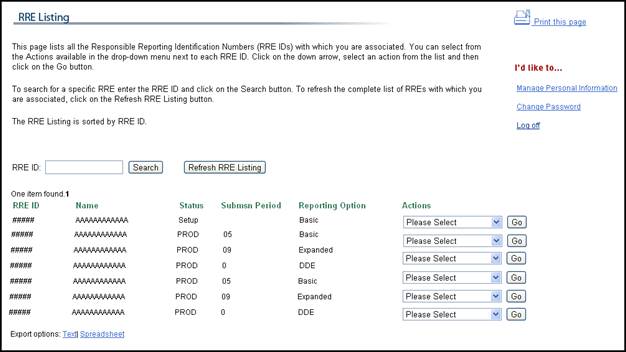

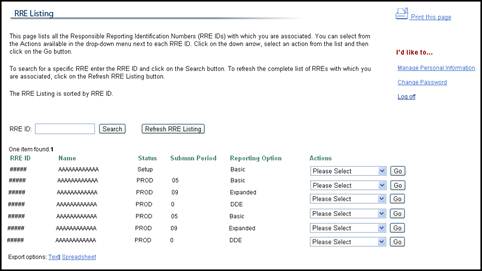

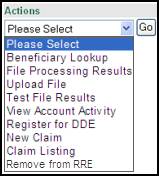

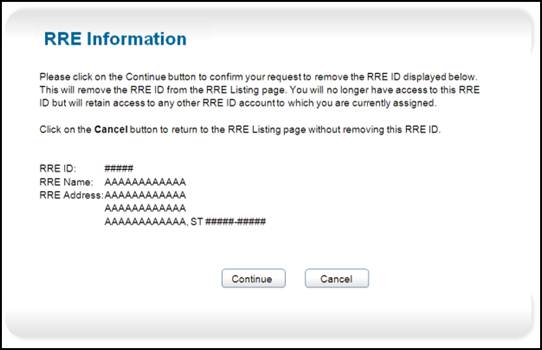

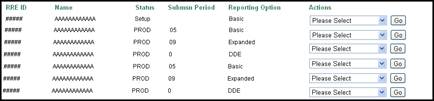

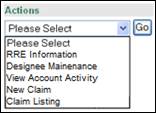

60. The RRE Listing page displays. This page functions as the main processing screen or Home page to initiate any Section 111 Web site processes. It lists all RRE IDs to which your Login ID is associated. Refer to Chapter 6 for more information about the RRE Listing page.

Figure 42: RRE Listing Page

1. On the Login screen, click the Forgot Login ID link in the Account Login box.

Figure 43: Account Login Box

2. This displays the Forgot Login ID page. Enter your E-mail address and click Continue.

Figure 44: Forgot Login ID Page

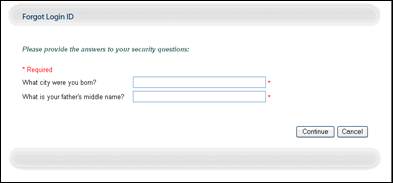

3.

The screen then re-displays with the two Security

Questions you selected during the registration process. Correctly answer each

of your pre-selected Security Questions then click the Continue

button. If the information you entered is correct, your Login ID will be sent

via E-mail.

If you receive an error indicating that the answers are incorrect, check your

answers and re-enter. If you cannot remember the answers to your Security

Questions, contact your assigned EDI Representative.

Figure 45: Forgot Login ID Page, Security Questions

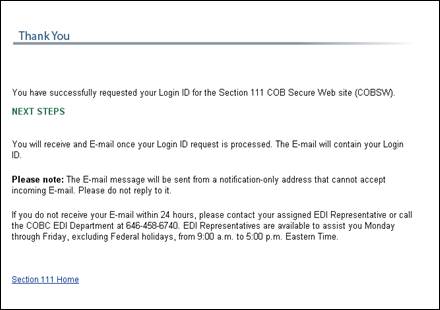

4. The Thank You page displays if your answers are correct. This page confirms that you have successfully requested your Login ID. You will then receive an E-mail containing your Login ID. After receipt of the E-mail, please return to the Section 111 Web site and log in using your Login ID and Password.

Figure 46: Thank You Page

If you do not

receive your E-mail within 24 hours, please contact your assigned EDI

Representative.

1. On the Login screen, click the Forgot Password link, in the box on the left of the screen.

Figure 47: Forgot Password Link

2. This displays the Forgot Password page. Enter your Login ID and click Continue.

Figure 48: Forgot Password Page

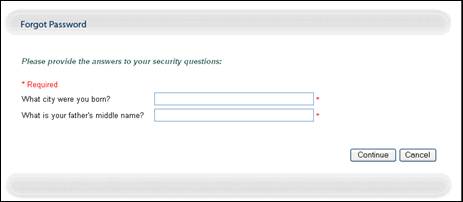

3. The screen then re-displays with the two Security Questions you selected during the registration process. Correctly answer each of your pre-selected Security Questions then click the Continue button. If the information you entered is correct, your new temporary Password will be sent via E-mail.

Figure 49: Forgot Password Page, Security Questions

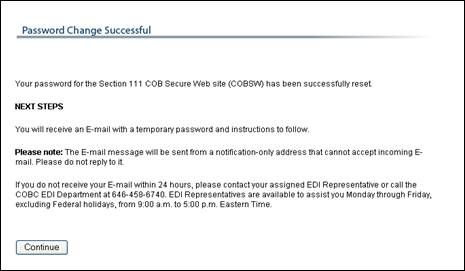

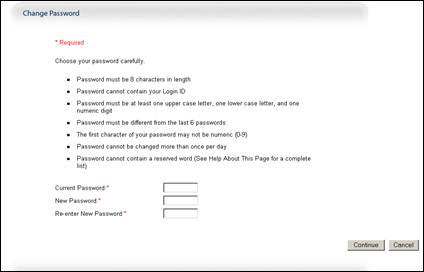

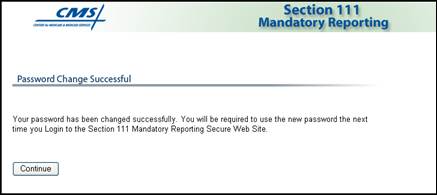

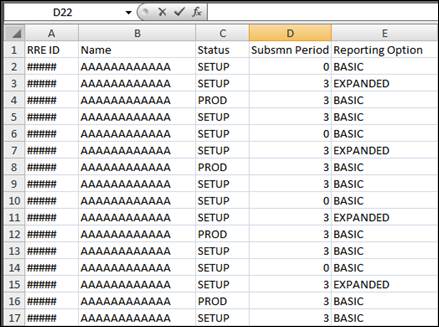

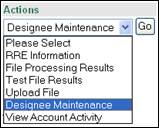

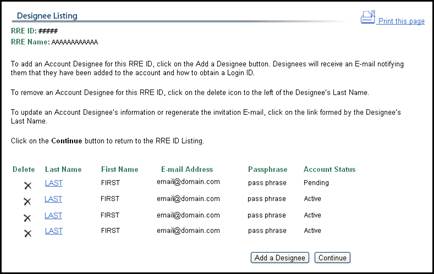

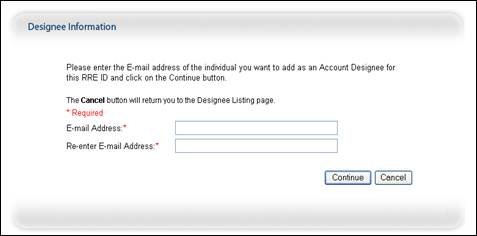

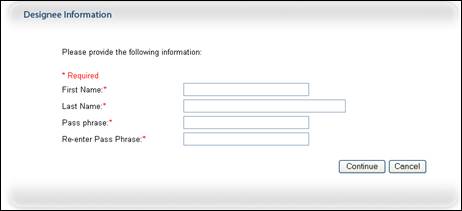

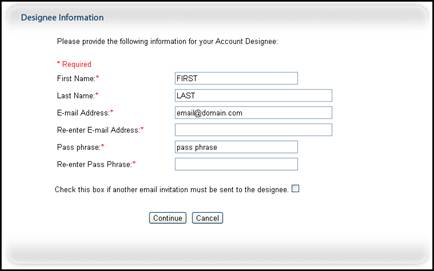

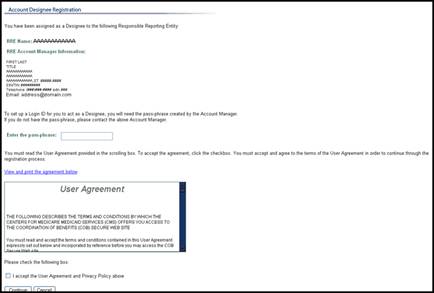

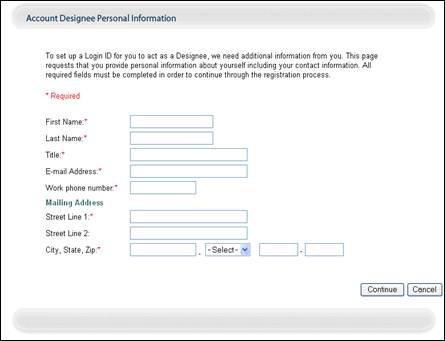

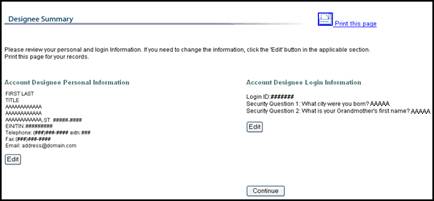

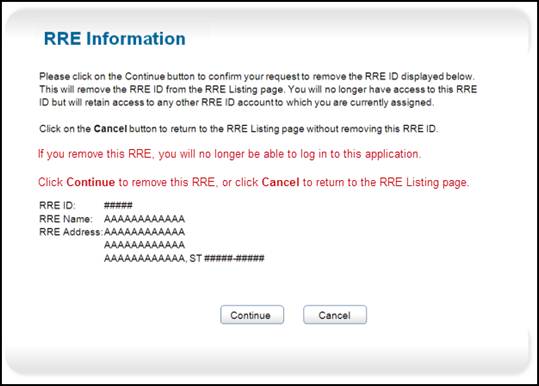

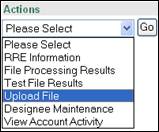

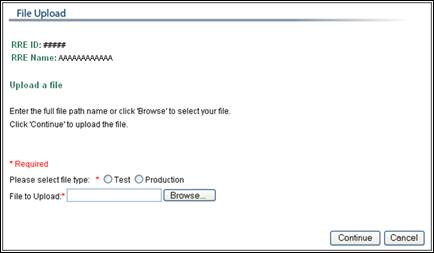

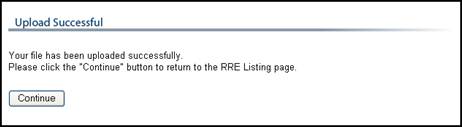

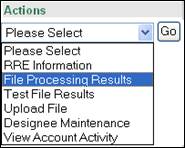

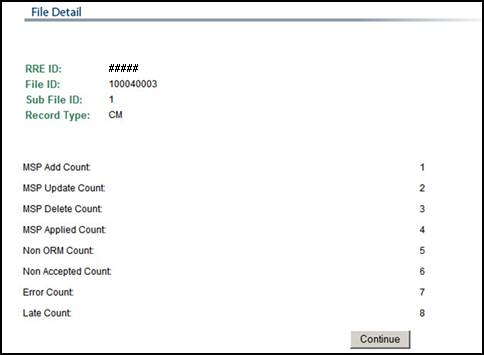

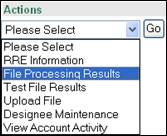

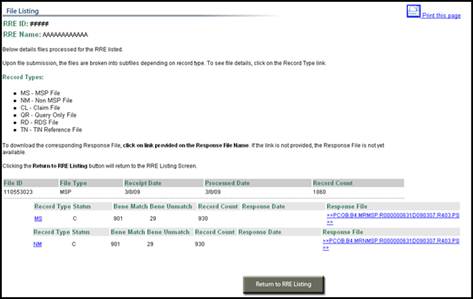

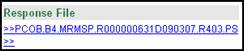

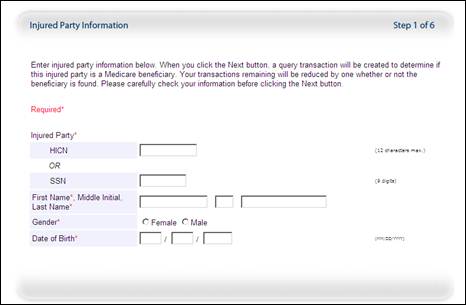

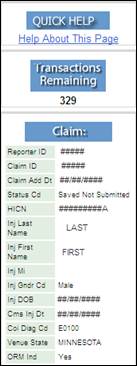

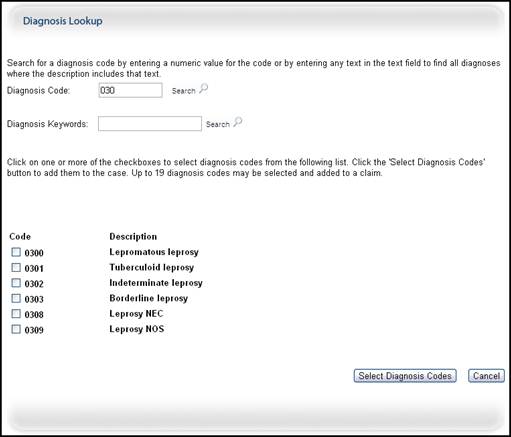

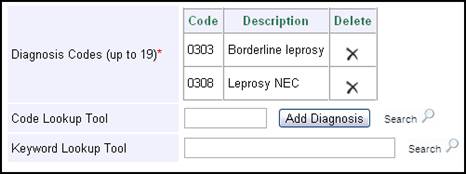

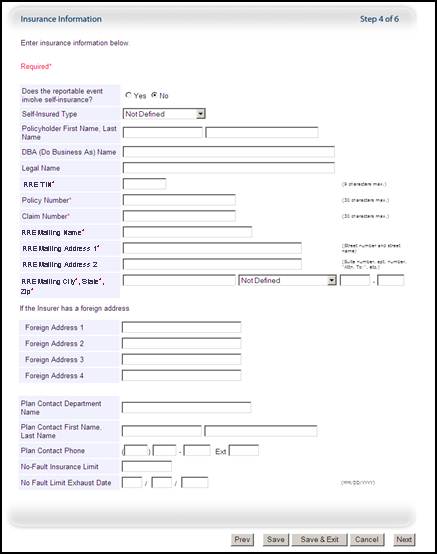

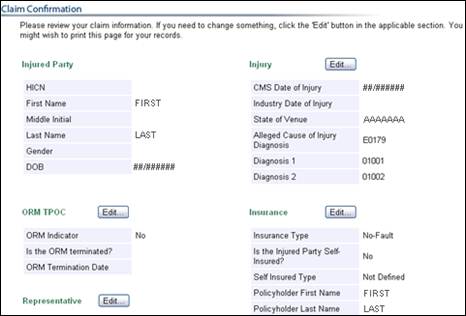

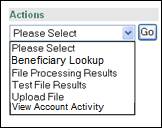

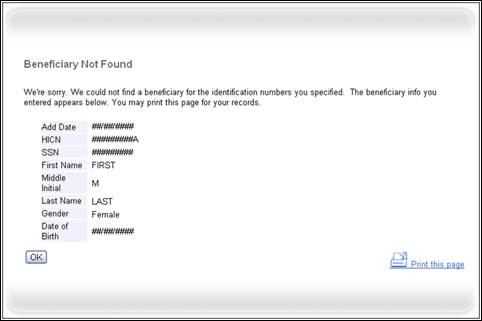

If you receive an error indicating that the answers are incorrect, check your answers and re-enter. If you cannot remember the answers to your Security Questions, contact your assigned EDI Representative.